Natural Gas regains the smile and revisits $2.60

Prices of natural gas seem to have met some decent support in the $2.40 region per MMBtu and manage to leave behind three consecutive daily pullbacks at the beginning of the week.

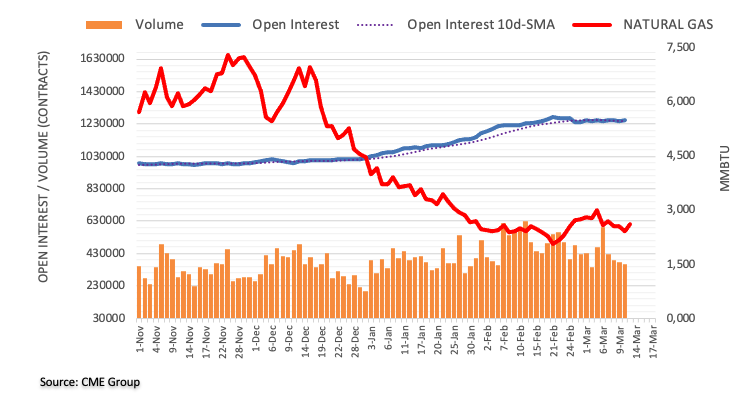

The commodity gathers some traction on the back of colder days ahead in the US, although the broad-based outlook remains tilted to the negative side amidst the absence of a strong driver for the time being. On this, Friday’s figures in natural gas futures markets appear to support the underlying negative outlook for the commodity in the very near term at least.

Against that, another test of the 2023 low in the sub-$2.00 region should not be ruled out, while the $3.00 mark continues to cap occasional bullish attempts for the time being. Above this region, natural gas should meet temporary resistance at the 55-day SMA at $3.145, just ahead of the Fibo retracement of the December-February drop at $3.182.

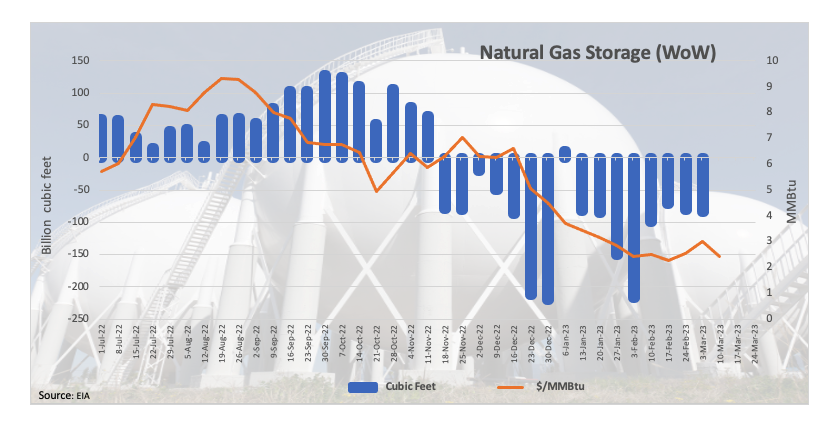

Later in the week, the EIA will release its weekly report on natural gas storage.

Natural Gas levels to watch

At the moment, Natural Gas prices are advancing 6.87% at $2.594 and faces the next up-barrier at $3.009 (monthly high March 3) seconded by $3.145 (55-day SMA) and finally $3.182 (Fibo retracement). On the downside, a break below $1.967 (2023 low February 22) would expose $1.795 (monthly low September 21 2020) and then $1.605 (monthly low July 20 2020).