Gold Price Forecast: XAU/USD prods $1,930 support ahead of multiple central bank news – Confluence Detector

- Gold Price lacks clear directions as bears struggle with $1,930 key support.

- Fed Chair Powell’s unimpressive testimony, off in China restricts immediate XAU/USD moves.

- Cautious mood ahead of multiple central bank announcements also prods Gold traders.

Gold Price (XAU/USD) remains on the back foot as it jostles with short-term key support, lacks a directional sense of late, as markets await a slew of central bank decisions. Apart from the pre-announcement anxiety, the holiday in China and mixed catalysts about the Fed also restrict the Gold Price moves.

Fed Chairman Jerome Powell stuck to hawkish bias in his bi-annual testimony to the US House Financial Services Committee the previous day. However, the absence of any fresh comments, as well as contrasting statements from other Fed Officials, weighs on the US Dollar and restricts XAU/USD moves.

Even so, major central banks’ defense of the “higher for longer” interest rate view and doubts about China’s rejections of recession woes, as well as the Sino-American tension, exert downside pressure on the Gold Price.

Moving on, monetary policy announcements from the UK, Switzerland, Mexico, Turkey and Indonesia are in the pipeline and can infuse the market’s volatility.

Also read: Gold Price Forecast: XAU/USD downside bias remains intact whilst below 100 DMA at $1,942

Gold Price: Key levels to watch

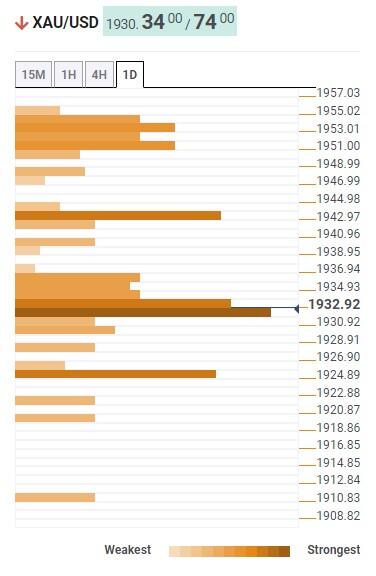

Our Technical Confluence Indicator signals that the Gold Price clings to a short-term key support around $1,930 comprising Pivot Point one-week S1, previous monthly low and Fibonacci 61.8% on the daily chart.

It’s worth noting that $1,924 also checks the XAU/USD bears before giving them control. That said, the $1,924 level encompasses the previous weekly low and Fibonacci 23.6% on the daily chart.

Meanwhile, the $1,942 level comprising the Fibonacci 38.2% on the weekly chart and 100-DMA appears a tough nut to crack for Gold buyers.

Following that, the 10-DMA and Pivot Point one-week R2, close to $1,950, will precede the $1,954 resistance confluence including Fibonacci 161.8% on the daily chart and the middle band of the Bollinger.

Overall, Gold Price remains on the bear's radar below $1,954 despite the latest inaction.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.