Gold Price Forecast: XAU/USD nurtures bearish bias below $1,940 – Confluence Detector

- Gold Price remains below the key resistance confluence despite the corrective bounce, eyes third weekly loss.

- Indecision about major central banks’ next moves, China woes keep XAU/USD rebond in check.

- Expectations of easing inflation pressure in US allowed Fed to tease policy pivot and favored Gold Price recovery.

- Additional signals of easing US price pressure, FOMC Minutes eyed for clear directions.

Gold Price (XAU/USD) licks its wounds at the lowest level in a month, snapping four-day downtrend as markets reassess previous fears of higher interest rates and geopolitical concerns about China. Also allowing the XAU/USD to lick its wounds at the multi-day low is the US Dollar’s failure to defend the late Thursday’s corrective bounce, as well as dicey US Treasury bond yields.

The Unimpressive US inflation data allowed the Fed policymakers to cheer the victory over price pressure while Reserve Bank of Australia (RBA) Governor Philip Lowe defends the latest pause in the monetary policy by citing fears of higher unemployment. Further, the latest Reuters polls about the Reserve Bank of New Zealand (RBNZ) and the European Central Bank (ECB) were also in favor of marking no interest rate changes in the next monetary policy meetings.

Elsewhere, the Chinese policymakers’ sustained defense of the Yuan also favors the market’s confidence that the Asian leader will overcome the economic fears, which in turn underpinned the latest cautious optimism and Gold Price.

It’s worth noting, that the light calendar and cautious mood ahead of the US PPI, Michigan Consumer Sentiment Index also tests the Gold buyers ahead of the next week’s Federal Open Market Committee (FOMC) monetary policy meeting minutes.

Also read: Gold Price Forecast: XAU/USD could correct before targeting key 200 DMA support

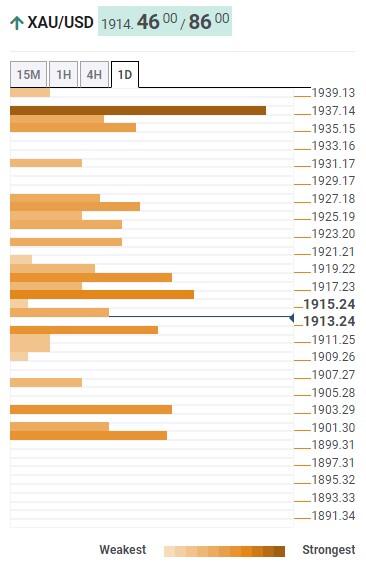

Gold Price: Key levels to watch

As per our Technical Confluence indicator, the Gold Price remains well below the $1,939 resistance confluence and teases the bears despite the latest struggles to overcome the immediate upside hurdle surrounding $1,918-20 comprising the lower band of the Bollinger and Fibonacci 23.6% on one-day.

It’s worth noting that the XAU/USD downside needs validation from the Pivot Point one-month S1, around $1,915.

Following that, the Gold bears will have a space before hitting the $1,905 support confluence including the previous monthly low. However, the Pivot Point one-week S2, around the $1,900 round figure, can challenge the XAU/USD bears past $1,905.

In a case where the Gold Price drops below the $1,900 threshold, June’s low of $1,893 will be in the spotlight.

Alternatively, a clear upside break of the aforementioned $1,918-20 resistance confluence could quickly fuel the Gold Price towards the previous weekly low and the Pivot Point one-day R1, close to $1,930.

If the Gold buyers manage to stay keep the reins past $1,930, Fibonacci 61.8% in one-month, near $1,938, may test the buyers before directing them to the multi-day resistance area surrounding $1,955.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.