The Italian vote: is the euro at risk?

What are we talking about?

The Italian bicameral system is ‘perfect’, which means that its two chambers’ powers are perfectly balanced. The problem with this ‘perfection’ is that more often than not it leads to political gridlocks and an infinite back-and-forth when comes to either pass a bill or amend one, adding to the already tedious and sadly famous Italian bureaucracy.

Primer Minister Matteo Renzi has pledged to eradicate – or at least diminish – this unnecessary bureaucracy, proposing a smaller and less powerful Senate among other changes, which should eventually become some sort of ‘Senate of Regions’ with the added value of rebalancing and redefining the relations between the central administration and local institutions.

Both chambers have already approved these changes, although the two-thirds required to pass the legislation through could not be reached, hence the call for a referendum.

It is imperative for PM Renzi to make the government not only more stable, but also more efficient. And to do that, he needs to change the Italian constitution, significantly. So the original referendum has morphed into a confidence vote for Renzi.

What could happen?

Nothing out of the ordinary so far. However, Renzi has stressed that he will step down if the ‘No’ wins, casting shadows over the status of the country within the European Union… and prompting the spectre of ‘Italexit’ to hover over the markets.

On the political side of the probable consequences in case Renzi resigns, other parties, most of them euro-skeptics – like Beppe Grillo’s MS5, former PM Silvio Berlusconi’s Forza Italia and the also separatist Lega Nord – are likely to benefit from the disturbance, although the most probable outcome would be the formation of a caretaker government.

A direct effect of such a scenario could bring forward the parliamentary elections originally expected in 2018, and with the recent advance of euro-skeptics, well… it could all intensify the mood towards an exit of the bloc.

So far… not so good

According to latest polls, the ‘No’ vote is leading, albeit by a slim margin. The problem seems to be that markets are still not even considering what could be a priori, a big-risk event, with the likeliness of a negative surprise gaining traction for the time being.

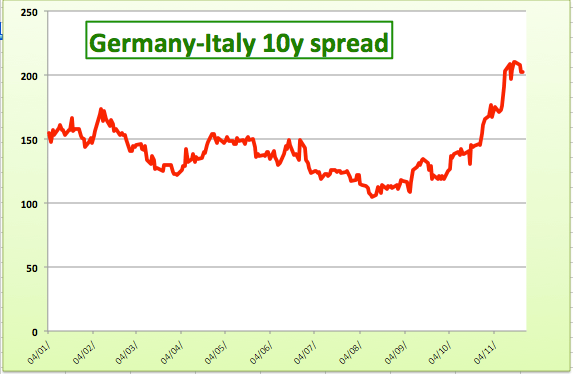

So far, Italian money markets (the fifth in the world) have reacted adversely, with the bonds sell-off intensifying further than its European peers as of late, this apart from the Trump-effect. The vote is vital as well to the Italian banking system, with Unicredit and Banca dei Monte Dei Paschi Di Siena in the eye of the storm. All seems to add to an already dangerous cocktail, where the general discontent on the underperformance of Italy since the adoption of the euro has never stopped from growing.

It is still premature to infer potential scenarios. While next days will probe to be crucial, polls are poised to drive the sentiment in the run up to the referendum, with the probable effects on the EUR depending greatly on the importance that market participants attach to the event.