US Dollar turns positive above 101.30 ahead of data

The greenback – in terms of the US Dollar Index (DXY) – keeps the trade within a tight range on Thursday, currently hovering over the 101.35/40 band.

US Dollar above 101.00 after FOMC

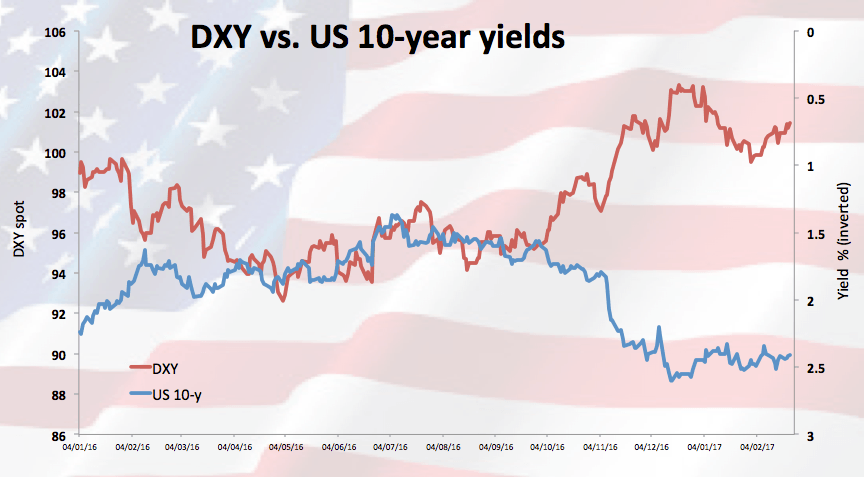

Despite the general positive tone from the FOMC minutes on Wednesday, the index found no excuses to extend the rally further north of recent tops above 101.70/75, giving away gains instead to overnight lows in the vicinity of 101.20 along with a sharp decline in US yields.

In fact, the Committee reiterated the good health of the economy, although uncertainty from ‘Trumponomics’ still persists. Few members still see a rate hike as soon as the next meeting, but the majority expects rate to go up later in the year.

On today’s data front, Initial Claims are due along with the Chicago National Activity Index and the speech by Atlanta Fed D.Lockhart (he will retire on February 28).

US Dollar relevant levels

The index is gaining 0.07% at 101.38 facing the next resistance at 101.75 (high Feb.15) ahead of 101.95 (23.6% Fibo of the November-January up move) and finally 102.96 (low Jan.11). On the flip side, a break below 101.16 (low Feb.22) would open the door to 101.08 (low Feb.21) and then 100.55 (20-day sma).