USD/CAD: breaking new highs and retreating to 1.3060

- The FOMC is scheduled on Wednesday and is the main event of the week.

- Canadian CPI and retail sales are scheduled on Friday, also likely a market mover event.

The USD/CAD is trading at around 1.3082 and closed the day down around 0.07% in a bearish day for the dollar which is now trading back below the 90 dollar mark.

The FOMC meeting takes place on Wednesday and the Fed is widely expected to hike 25 bps. A 50bps would be a major surprise for the market but is much less likely according to analysts. Market participants will likely make their mind if they see three or four rate hike coming this year.

Bank of Canada’s Wilkins is set to speak on Wednesday while the Canadian CPI and retail sales are expected on Friday at 12.30 GMT.

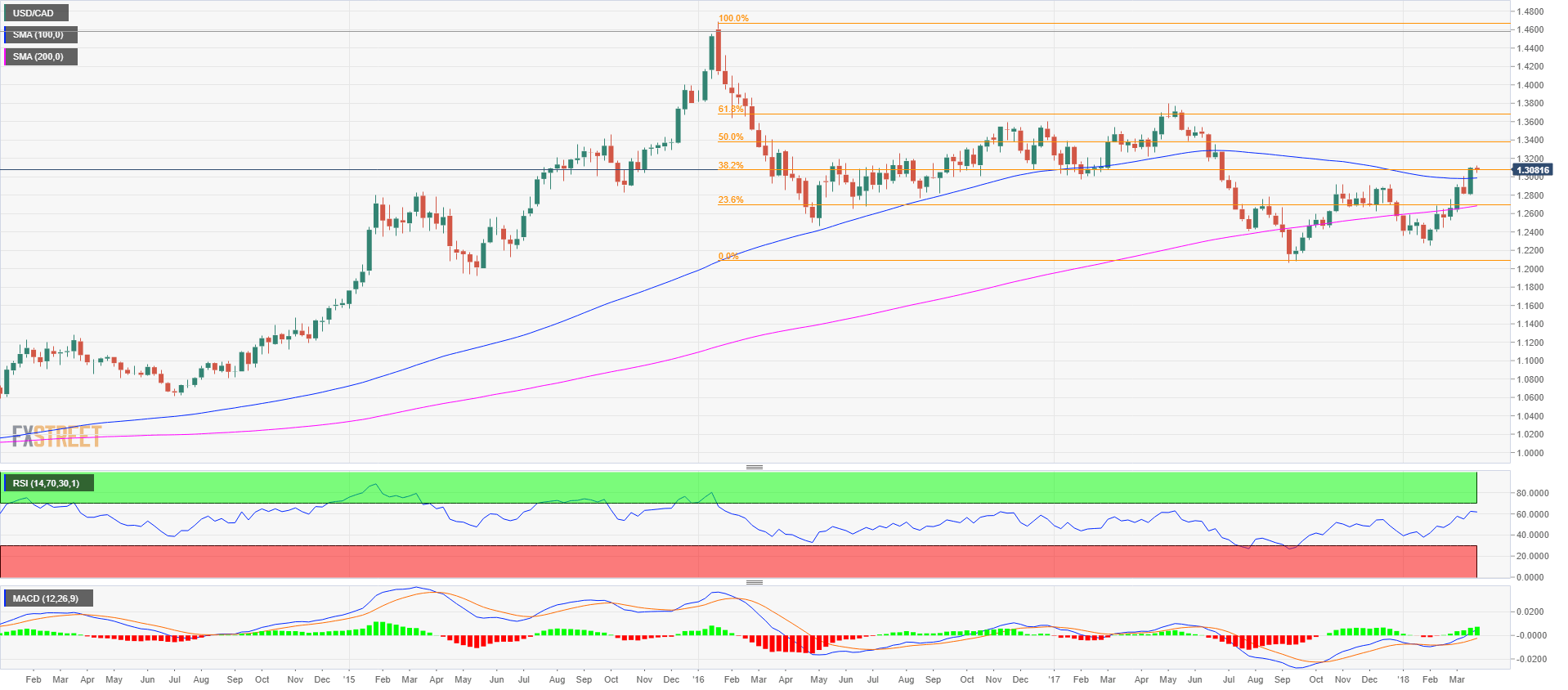

USD/CAD weekly chart

Last week the USD/CAD broke above the 100-period simple moving average with a strong bullish bar closing on its high suggesting that the buyers were eager to buy until the very last tick. The rally found resistance at the 1.3080 level which is the 38.2% Fibonacci retracement from the 2016-2018 bear trend. Next weekly resistance is seen at 1.3400, 50% Fibonacci retracement and 1.3670, 61.8% Fibonacci retracement, while support is seen at around 1.2600 with the 23.6 Fibonacci retracement and the 200-period simple moving average followed by 1.2250 last swing low. The RSI and MACD look healthy and bullish.

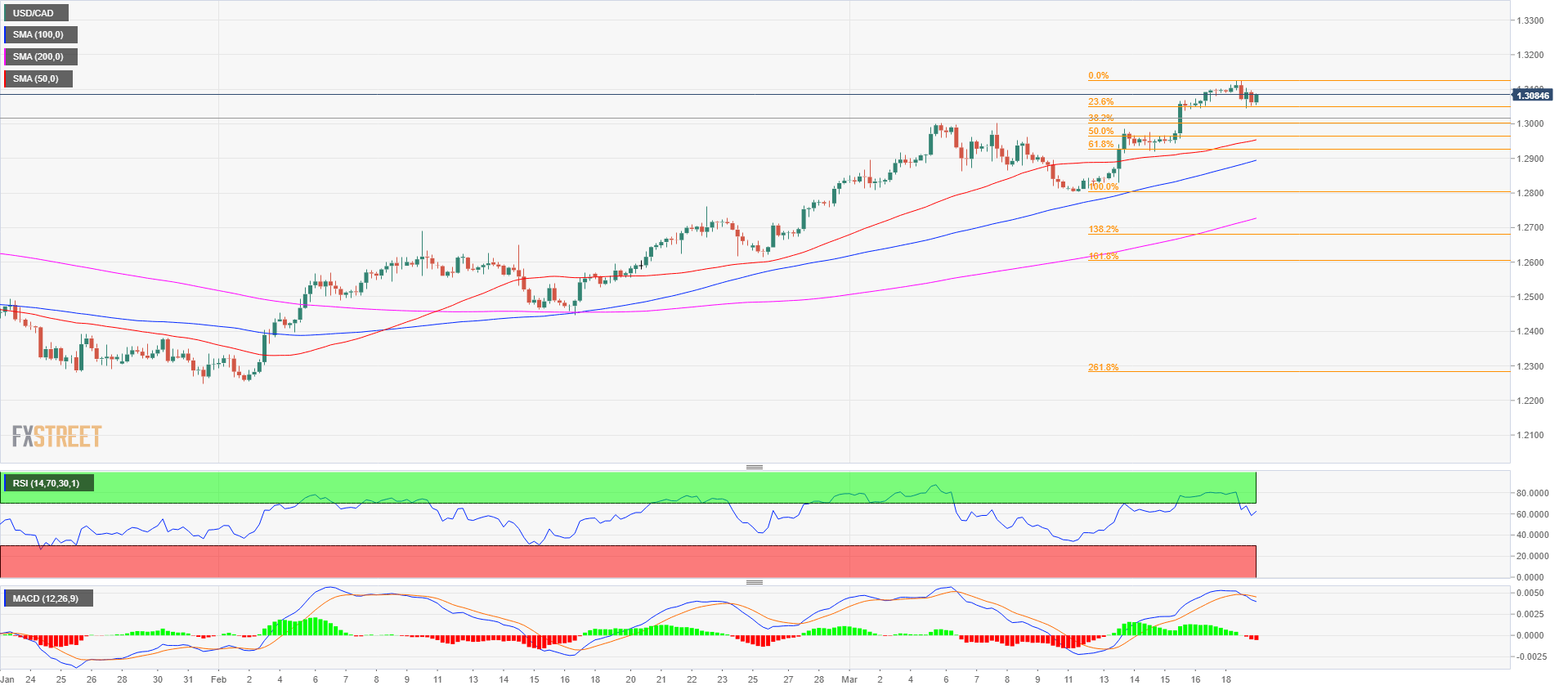

USD/CAD 4-hour chart

The USD/CAD has found support at the 23.6 Fibonacci retracement from the last bull leg as shown in the chart above on the 4-hour chart. Support is seen at 1.3000 figure and former cyclical high, followed by 1.2950. Resistance is seen at 1.3200 figure and 1.3400 weekly 50% Fibonacci retracement. Investors will pay attention to any breakout in the price of crude oil as it would likely affect the price of the USD/CAD as, usually, a higher crude oil price is beneficial for the CAD.