Gold Technical Analysis: any meaningful rebound likely to get sold into

• Struggles to register any meaningful recovery despite reviving safe-haven demand, amid concerns over a full-blown global trade war, and slightly oversold conditions.

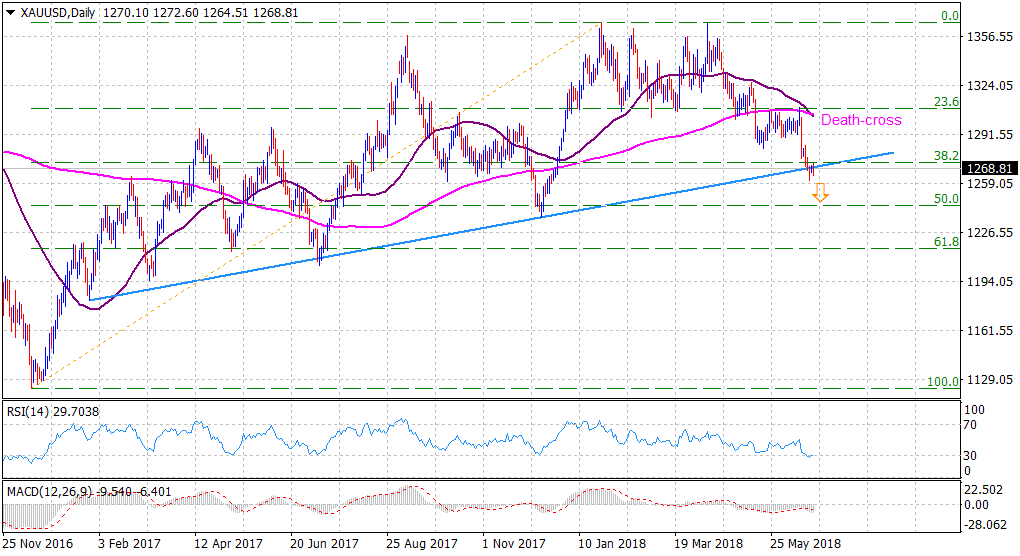

• An occurrence of death cross on the daily chart, 50-day SMA crossing the very important 200-day SMA from the top, adds credence to last week's bearish break below a medium-term ascending trend-line, extending from Jan. 2017 lows through lows touched in July/Dec. 2017.

• Acceptance below 38.2% Fibonacci retracement level of the Dec. 2016-Jan. 2018 up-move ($1123-$1366) further reinforces the bearish the negative outlook and hence, any recovery attempts are likely to get sold into.

Gold daily chart

Current Price: $1269

Daily High: $1272

Daily Low: $1264

Trend: Bearish

Resistance

R1: $1273 (38.2% Fibo. level)

R2: $1278 (horizontal level)

R3: $1284 (last week's swing high)

Support

S1: $1261 (YTD low set on June 21)

S2: $1253 (Horizontal level)

S3: $1244 (50% Fibo. level)