US Dollar Index Technical Analysis: Rising wedge can send DXY down to 97.00 figure

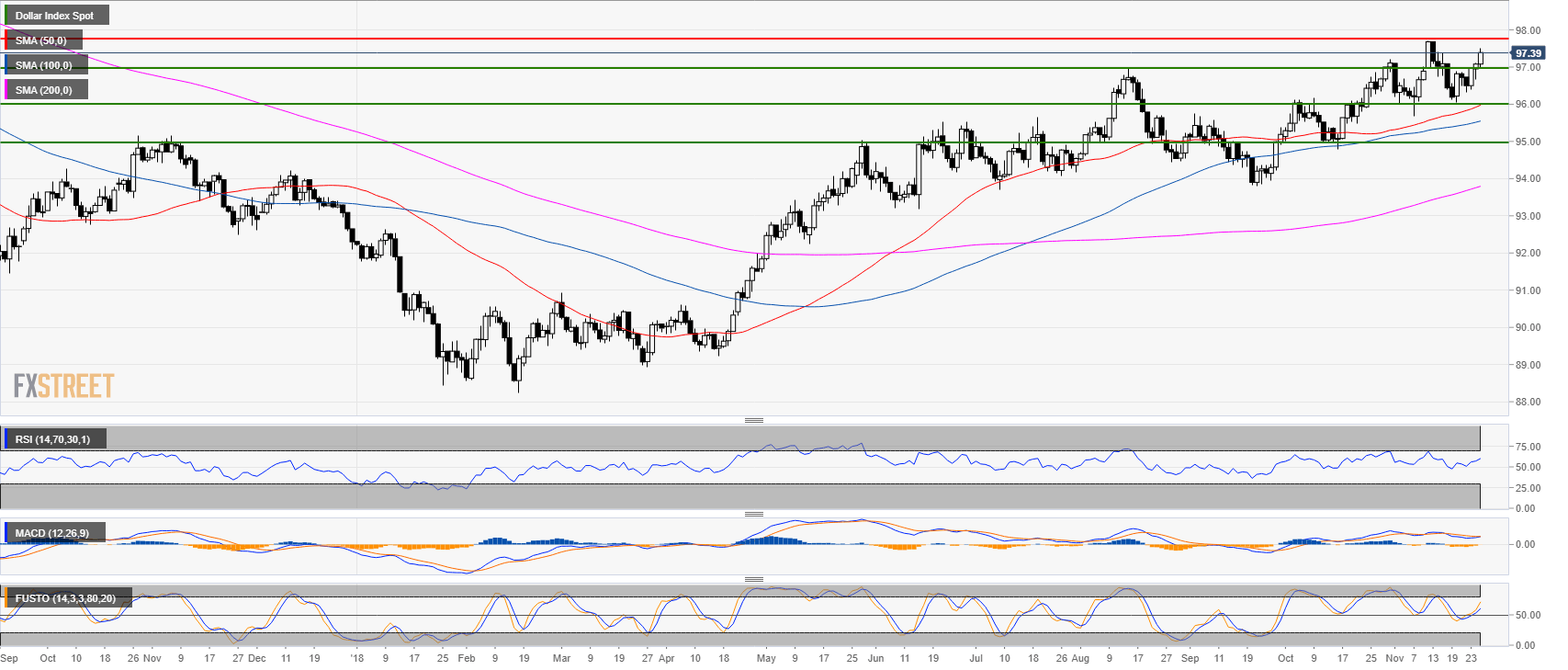

US Dollar Index (DXY) daily chart

- DXY is trading in a bull trend above the 50, 100 and 200-day simple moving averages (SMAs).

- DXY broke above the 97.00 figure as bulls are targeting the 2018 high.

- The RSI, MACD and Stochastic indicators are bullishly configured.

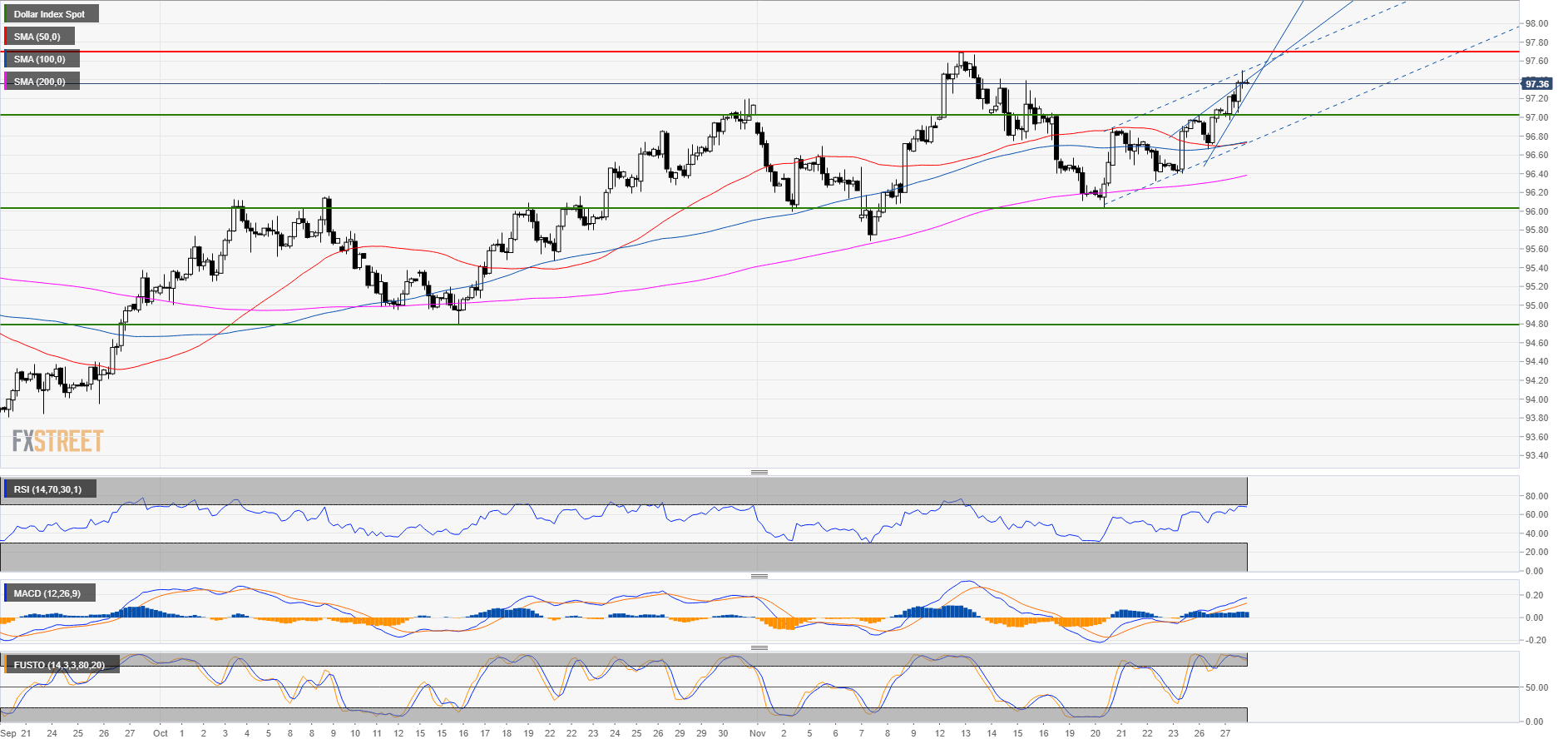

DXY 4-hour chart

- DXY is a the top of a bullish channel while the market formed a rising wedge. While a spike to 97.70 (2018 high) can still potentially be on the cards, the current market structure suggests a bullish exhaustion in the coming sessions.

- The RSI and MACD are bullishly configured while the Stochastic indicator is in the overbought zone.

- A failure below the 2018 high would likely see a retest of the 97.00 figure.

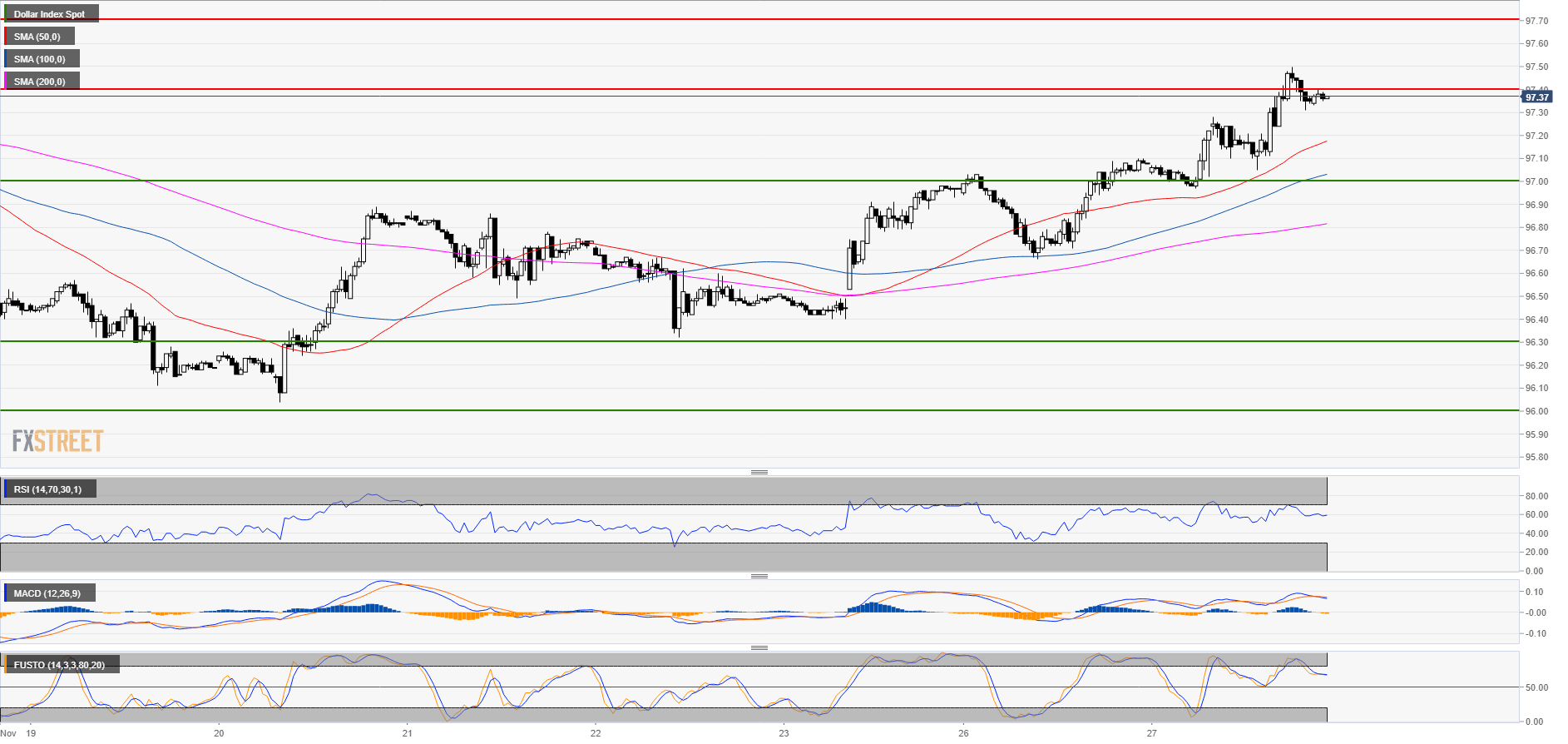

DXY 30-minute chart

- The lower time-frames are still quite bullish with DXY above the 50, 100 and 200 SMAs.

Additional key levels

Dollar Index Spot

Overview:

Today Last Price: 97.36

Today Daily change: 28 pips

Today Daily change %: 0.288%

Today Daily Open: 97.08

Trends:

Previous Daily SMA20: 96.75

Previous Daily SMA50: 95.92

Previous Daily SMA100: 95.52

Previous Daily SMA200: 93.76

Levels:

Previous Daily High: 97.1

Previous Daily Low: 96.66

Previous Weekly High: 96.98

Previous Weekly Low: 96.04

Previous Monthly High: 97.2

Previous Monthly Low: 94.79

Previous Daily Fibonacci 38.2%: 96.93

Previous Daily Fibonacci 61.8%: 96.83

Previous Daily Pivot Point S1: 96.79

Previous Daily Pivot Point S2: 96.51

Previous Daily Pivot Point S3: 96.35

Previous Daily Pivot Point R1: 97.23

Previous Daily Pivot Point R2: 97.39

Previous Daily Pivot Point R3: 97.67