US Dollar Index sticks to the positive ground above 96.00

- The index remains sidelined just above the 96.00 mark today.

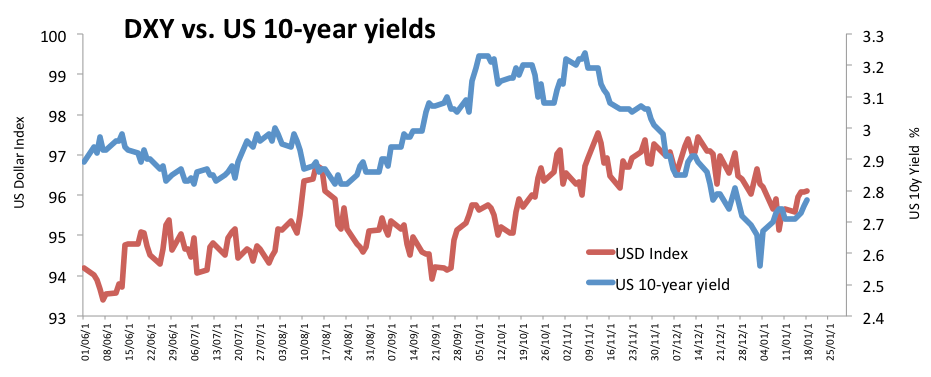

- Yields of the US 10-year note climb to fresh tops near 2.78%.

- November Industrial Production, flash January U-Mich index next on tap.

The greenback is prolonging the sideline theme just above 96.00 the figure so far this week when gauged by the US Dollar Index (DXY), all amidst the persistent decline in volatility in the global markets.

US Dollar Index looks to data

The index is up for the fourth session in a row today on the back of a moderate rebound in the demand for the buck, managing at the same time to prolong the bounce off last week’s 2019 lows in the 95.00 neighbourhood.

Declining volatility, a dovish message from ECB’s Mario Draghi and upbeat results from the Philly Fed index are all sustaining the correction higher in the buck, also aided by the lack of relevant news in the US-China trade dispute and a pick up in yields of the US 10-year note to the boundaries of 2.78%, or 3-week tops.

In the US data sphere, Industrial Production figures during November are coming up next seconded by January’s advanced Consumer Sentiment tracked by the U-Mich index.

What to look for around USD

The ongoing context of marginal volatility and lack of catalysts leaves the scenario unchanged for the greenback in the very near term. That said, the prospects of a ‘no-hike’ by the Federal Reserve this year coupled with speculations of a slowdown in the US economy remain the centre of attention among investors. In addition, the US partial shutdown is entering its fourth consecutive week and could start weighing on sentiment, while cautiousness remains high around the US-China trade talks.

US Dollar Index relevant levels

At the moment, the pair is up 0.03% at 96.10 and a break above 96.26 (high Jan.17) would target 96.60 (55-day SMA) en route to 96.96 (2019 high Jan.2). On the downside, the next support arises at 95.77 (10-day SMA) seconded by 95.03 (2019 low Jan.3) and finally 95.04 (200-day SMA).