Back

12 Jul 2019

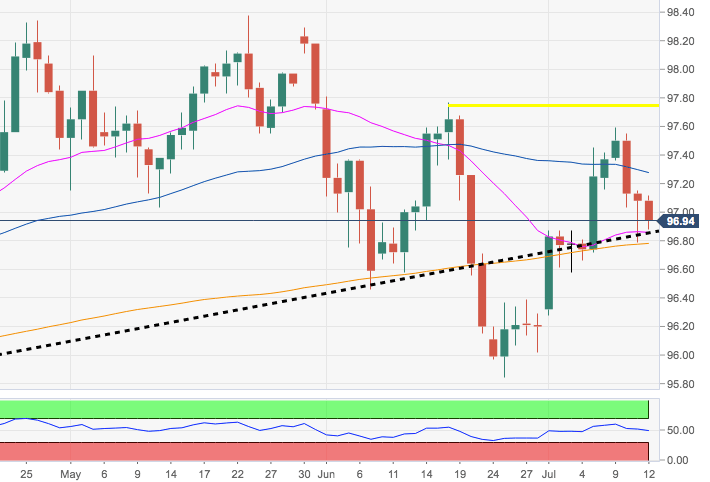

US Dollar Index Technical Analysis: The greenback stays supported by the 200-day SMA at 96.71

- The sharp correction lower in the greenback sponsored by Powell and the FOMC minutes appears to have met contention in the 96.85./80 band, where sits the multi-month support line off September 2018 lows.

- If the selling impulse gathers traction, the critical 200-day SMA at 96.71 should offer extra contention. A move to this area could threaten the constructive view on the buck.

- In case bulls reverse the ongoing decline, interim resistance should come in at 97.59, monthly peaks so far ahead of June top at 97.80.

DXY daily chart