Back

6 Nov 2019

USD/JPY technical analysis: The Greenback might be heading towards the 110.00 handle

- USD/JPY is challenging the 109.00 handle and the 200 DMA.

- The level to beat for buyers is the 109.29 resistance.

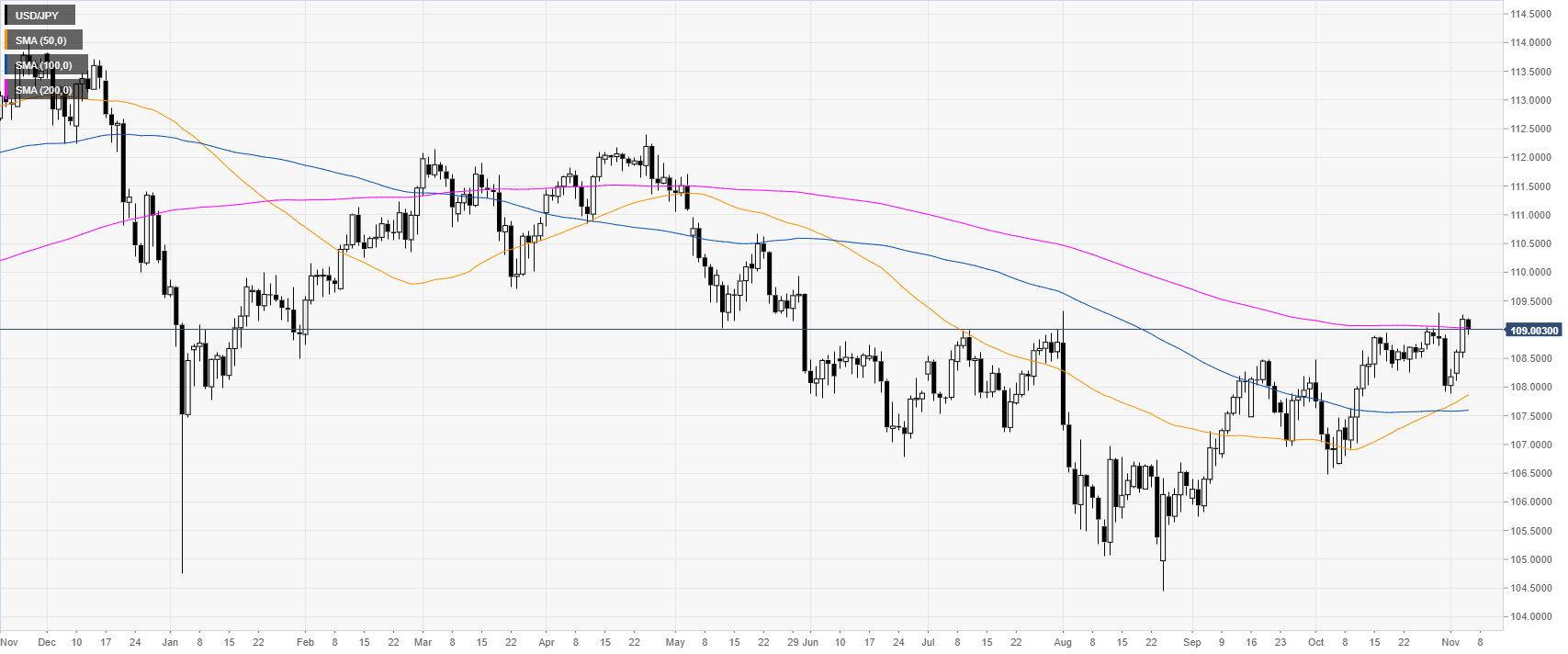

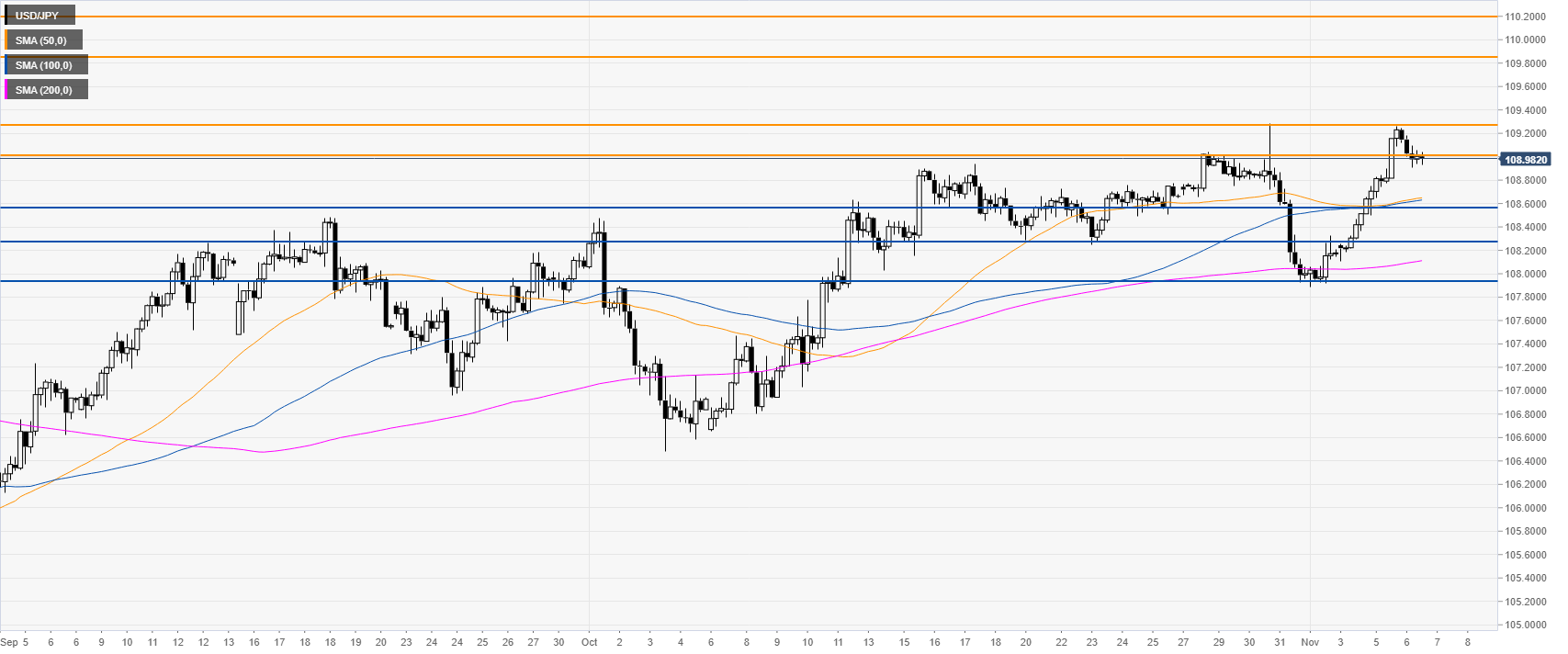

USD/JPY daily chart

USD/JPY is challenging the 109.00 handle and the 200-day simple moving average (SMA) on the daily chart. In both September and October, the market has been consistently gaining strength.

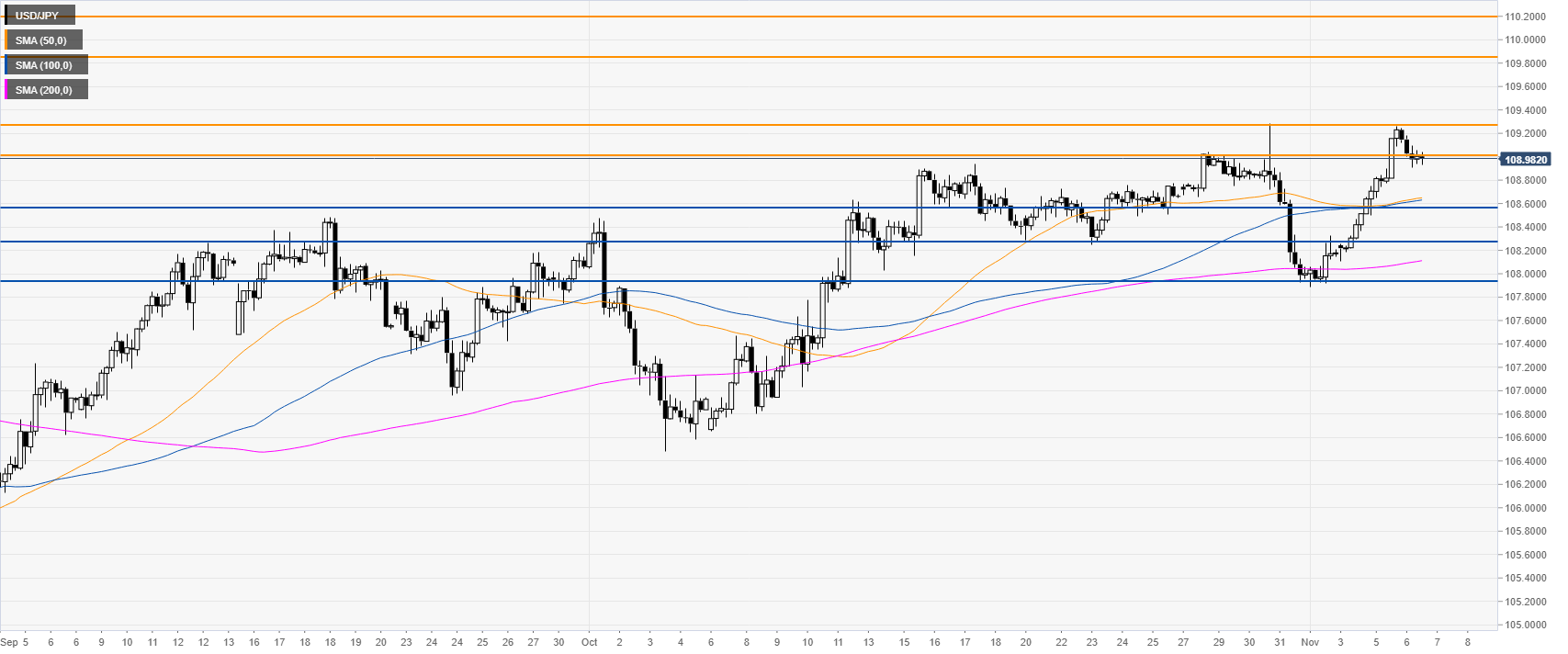

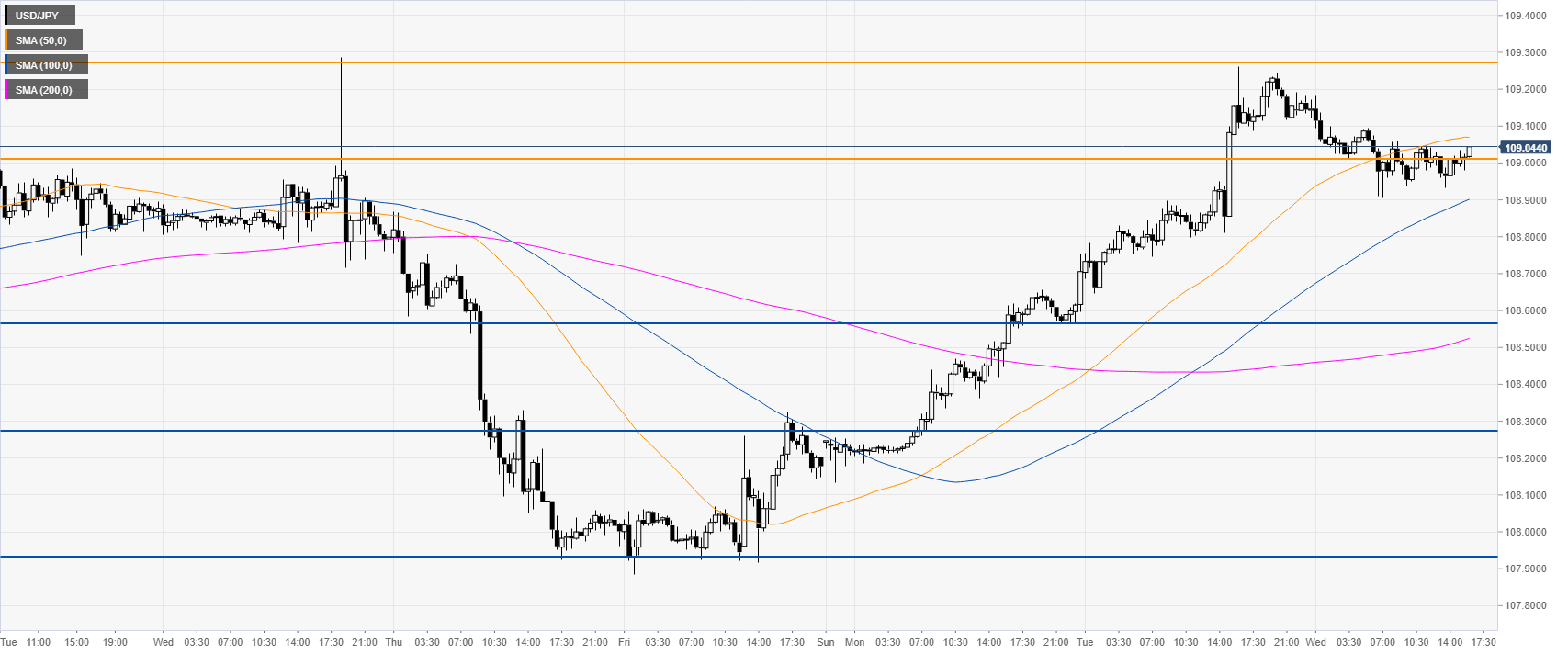

USD/JPY four-hour chart

USD/JPY is trading above its main SMAs on the four-hour chart, suggesting a bullish momentum in the medium term. Bulls want to overcome the 109.29 resistance to extend the bullish leg towards the 109.85 and 110.20 price levels, according to the Technical Confluences Indicator.

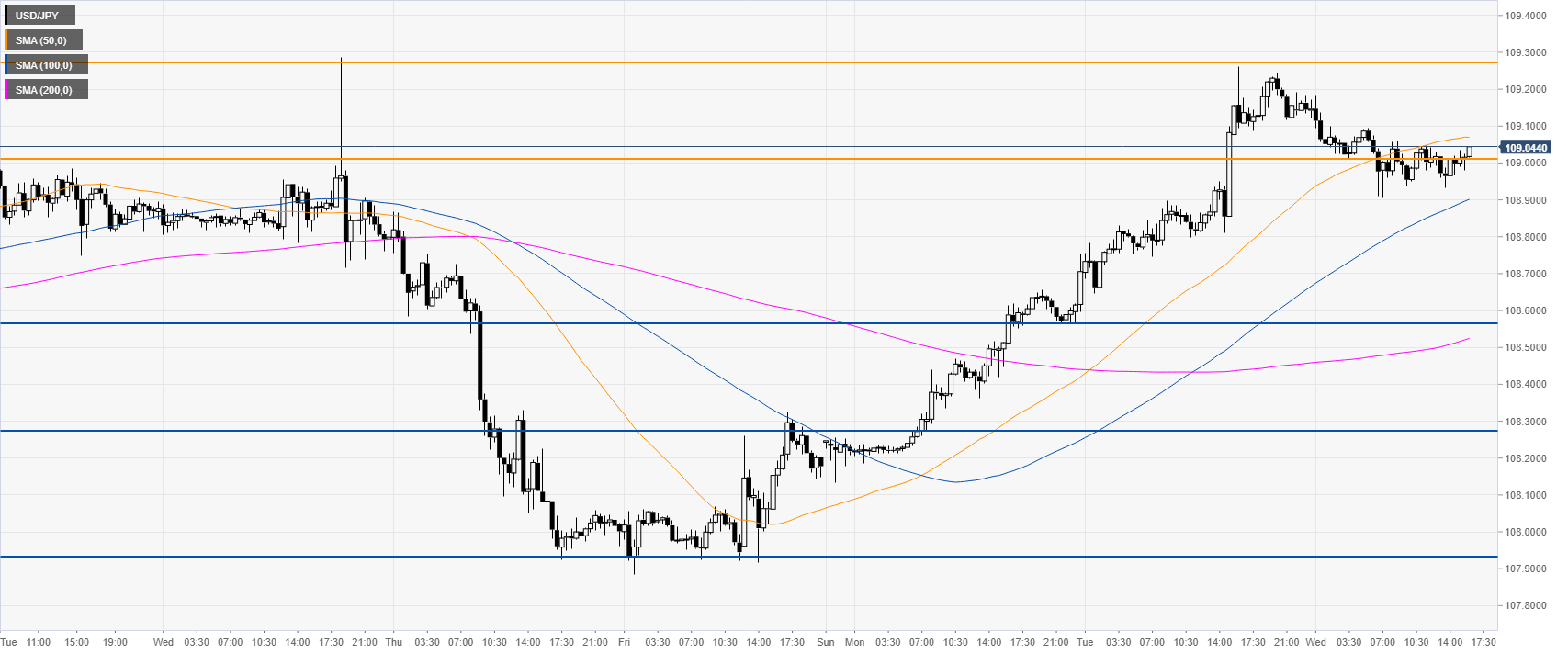

USD/JPY 30-minute chart

USD/JPY is trading above the upward sloping 100 and 200 SMA, suggesting a bullish bias in the near term. Support is seen at the 109.00 figure followed by the 108.55 and 108.27 levels, according to the Technical Confluences Indicator.

Additional key levels