Back

2 Dec 2019

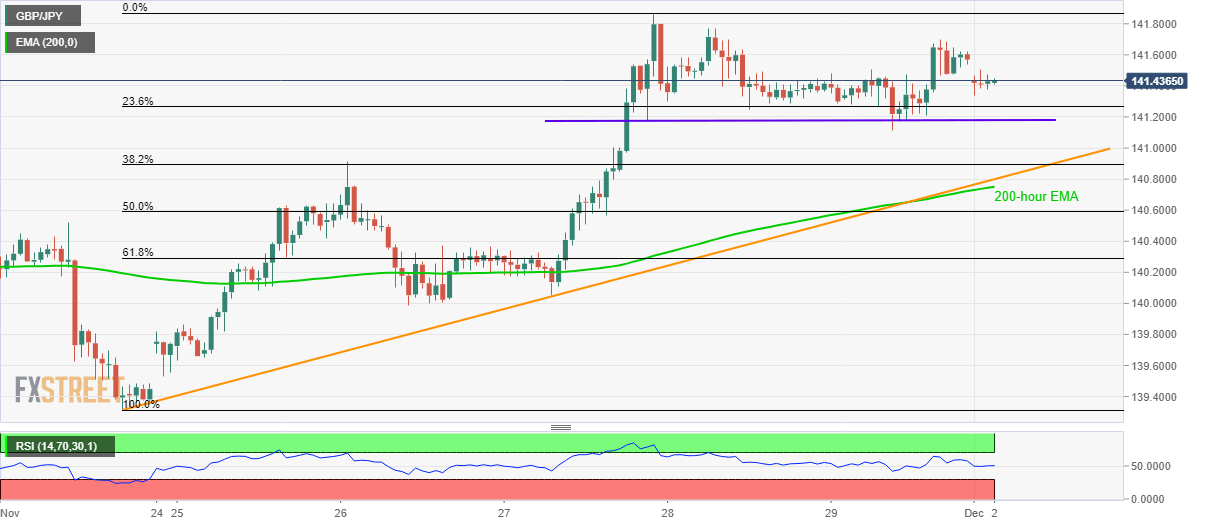

GBP/JPY Technical Analysis: Buyers keep lurking around 141.20/15

- GBP/JPY struggles to stay strong around a multi-month high.

- A downside break of immediate horizontal support shifts focus on a one-week-old rising trend line and 200-hour EMA.

- March/April lows seem to grab buyers’ attention during the further rise.

Pullbacks from multi-month high flash 141.45 as a quote for the GBP/JPY pair during Monday’s Asian session. The pair, however, is yet to slip beneath near-term horizontal support.

The 141.20/15 area holds the key to the pair’s further declines towards a one-week-old rising trend line and 200-hour Exponential Moving Average (EMA), around 140.80/75.

Should prices fail to recover around 140.75, November 26 low near 140.00 will be on the sellers’ radar ahead of 139.30 rest-point.

Meanwhile, buyers look for a clear break of the recent high surrounding 141.90 to take aim at lows marked during March and April month, around 143.72/78.

GBP/JPY hourly chart

Trend: Pullback expected