Back

7 Dec 2019

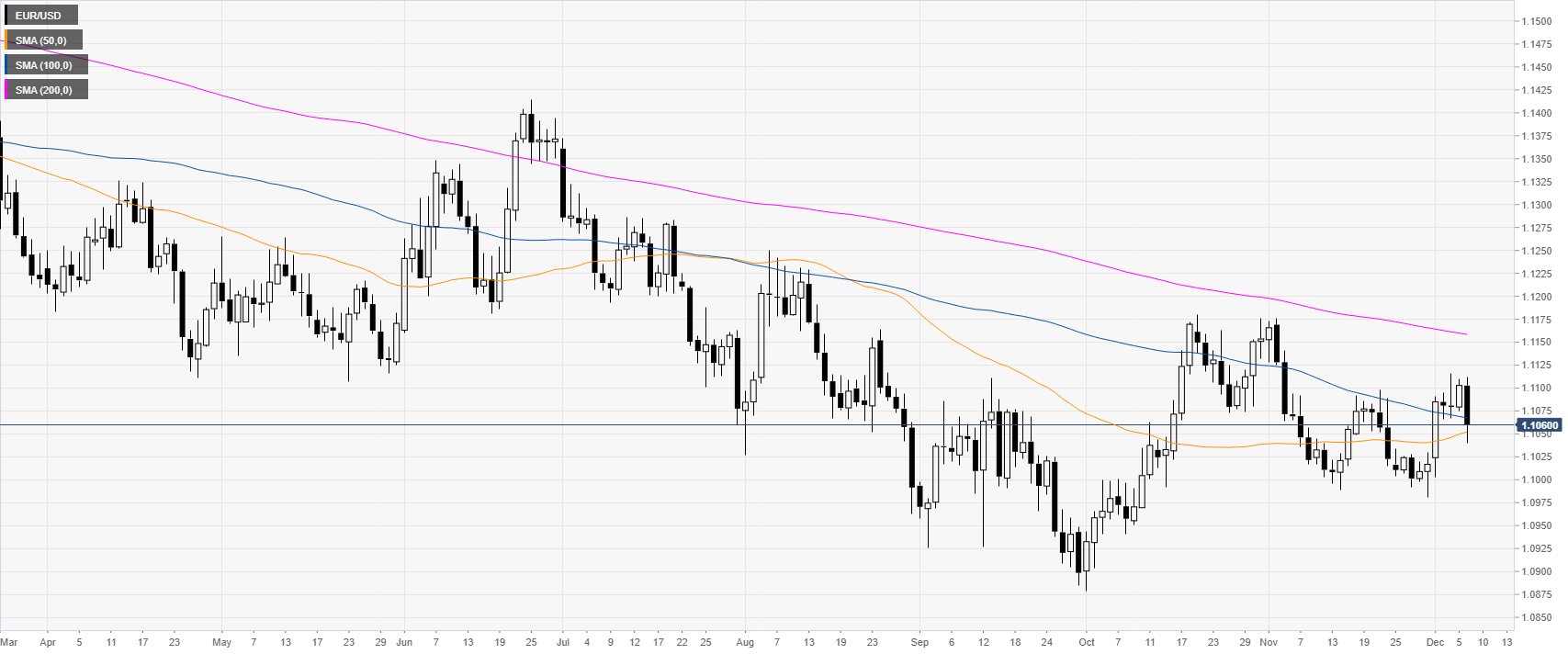

EUR/USD price analysis: Will the euro bears finally commit?

- EUR/USD neutral/bullish bias remains in place despite the dip caused by the NFP.

- The level to beat for buyers is the 1.1063 resistance.

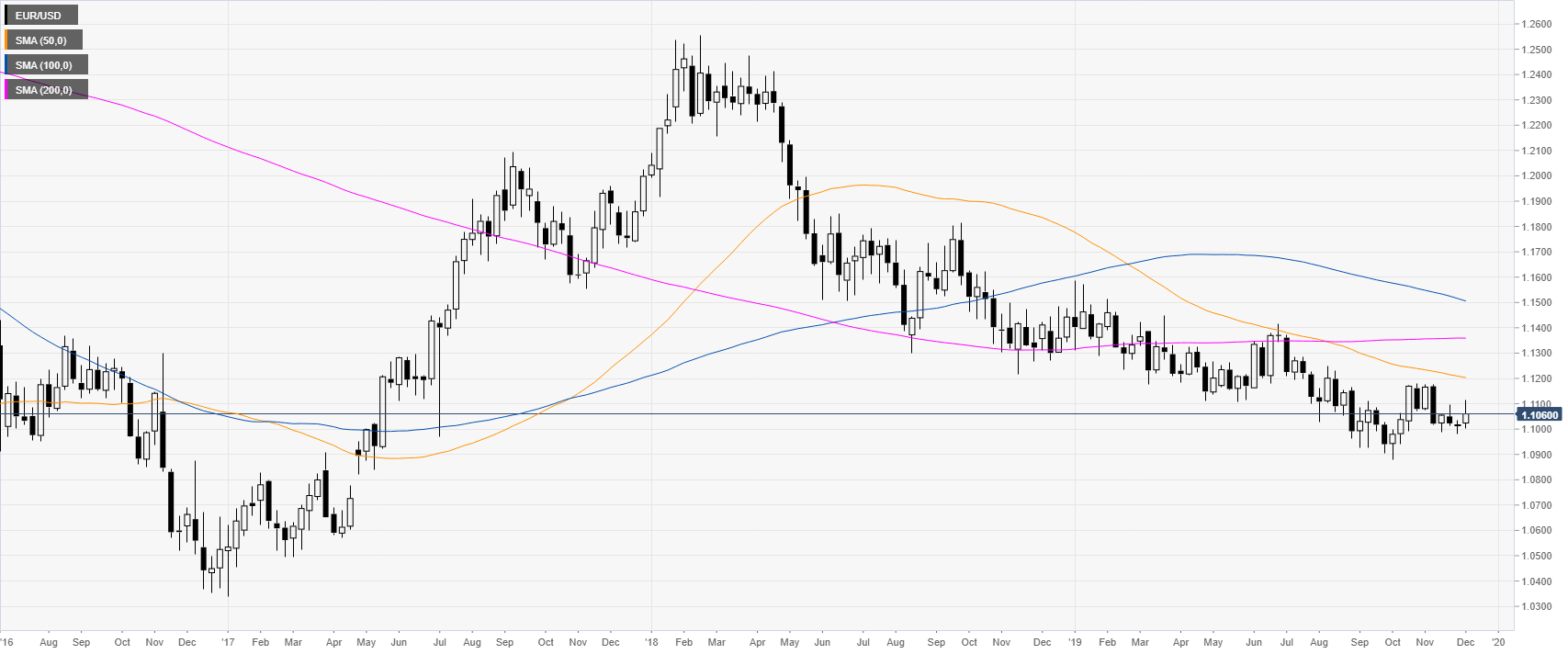

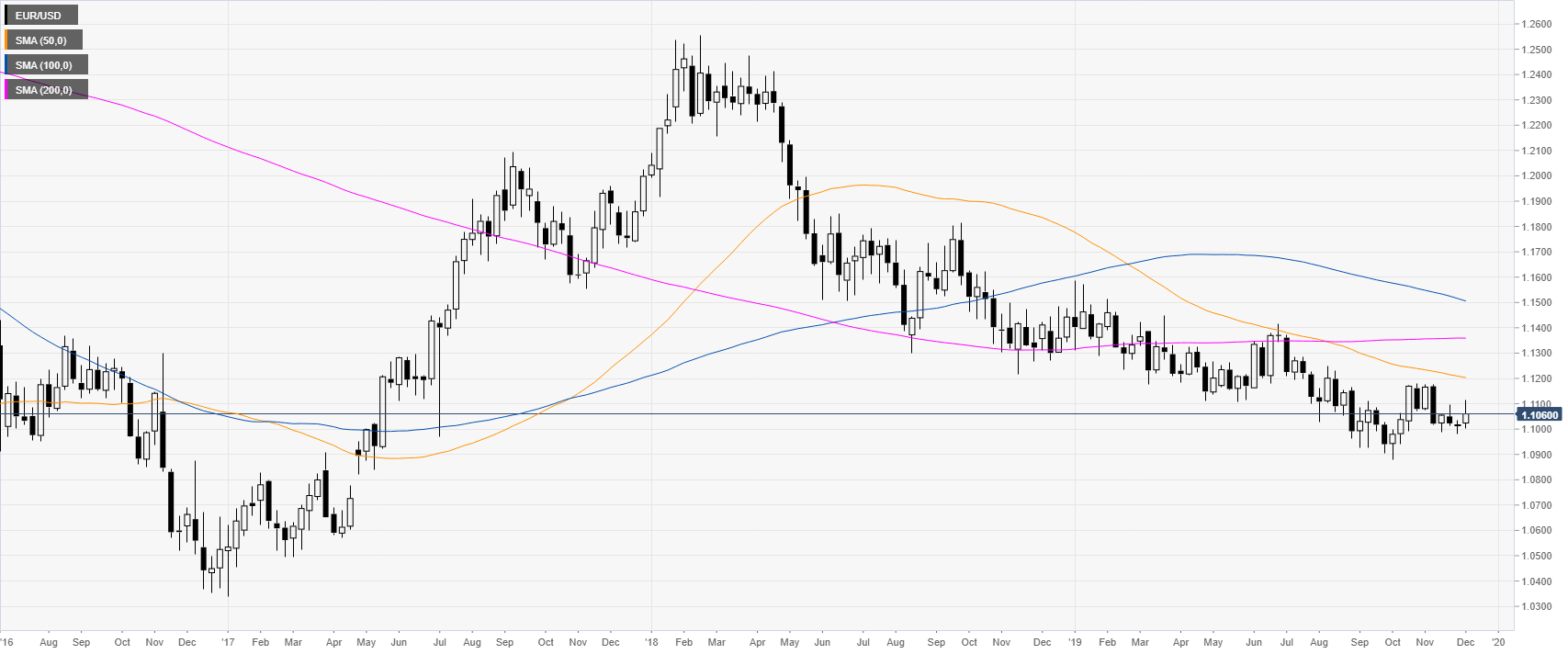

EUR/USD weekly chart

The euro is trading in a weak bear trend below its main weekly simple moving averages (WMAs). The market has been holding above the 1.1000 handle for eight consecutive weeks, reinforcing the bull case.

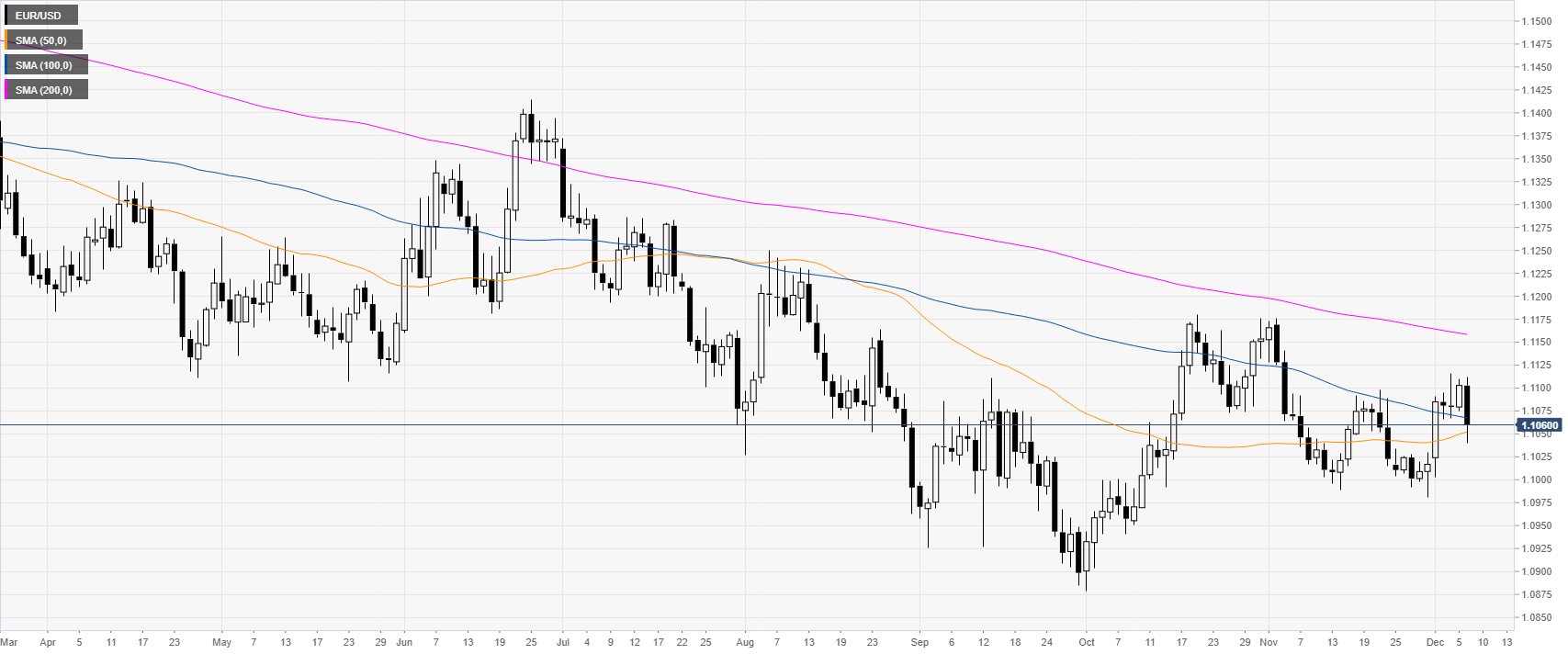

EUR/USD daily chart

EUR/USD, on the daily time frame, is trading below the 200-day simple moving average (DMA). However, in December, the market had a significant bullish reversal. The bears will likely need to have a daily close below the 1.1000 handle in order to restore a clear bearish bias.

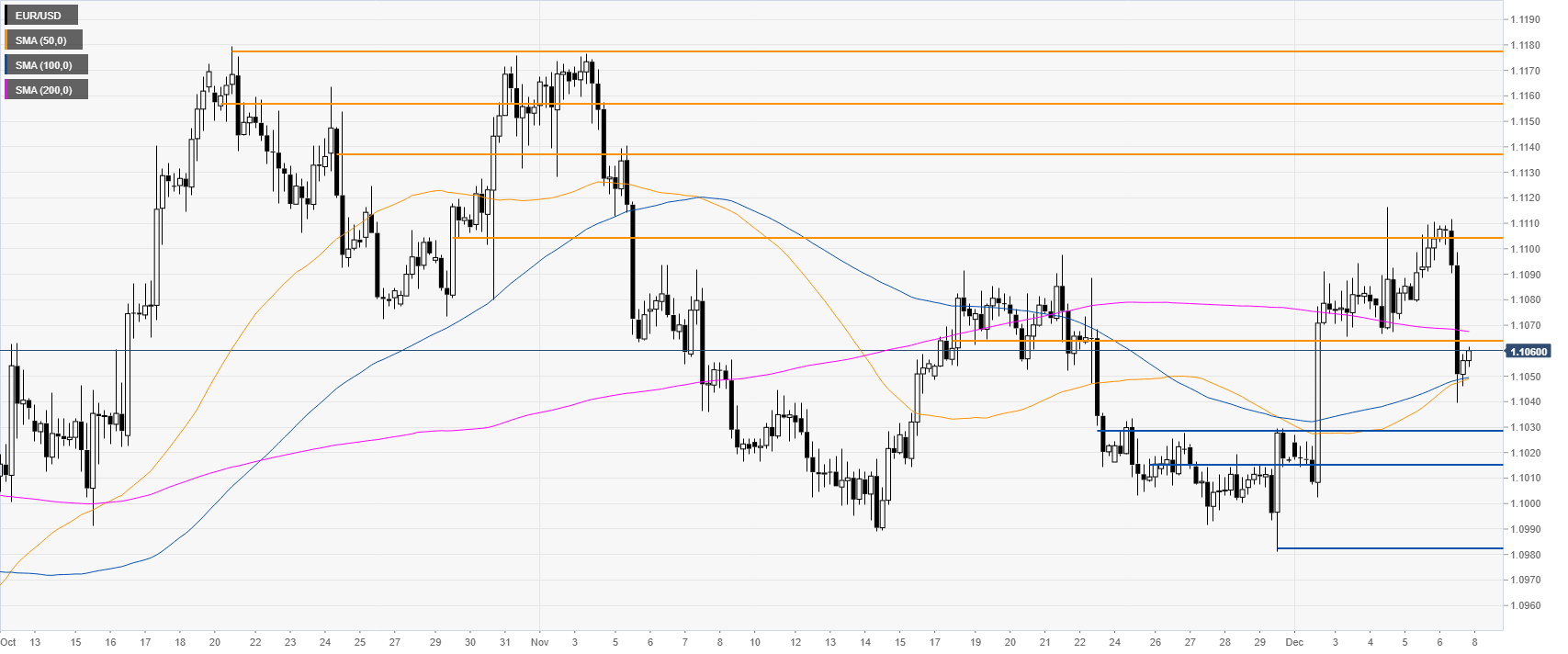

EUR/USD four-hour chart.

EUR/USD is rebounding from the 50/100 SMAs. If bulls overcome the 1.1063 resistance, the buyers will likely try to reach the 1.1103 resistance one more time. Further up lie the 1.1137, 1.1155 and 1.1178 price levels. Support is seen at the 1.1028/17 price zone and 1.0982 level, according to the Technical Confluences Indicator.

Additional key levels