When are the Eurozone Preliminary CPIs and how could they affect EUR/USD?

Eurozone Preliminary CPIs overview

Eurostat will publish the first estimate of Eurozone inflation figures for December at 1000 GMT today. The headline CPI is anticipated to inch higher to 1.3% YoY while the core inflation is also seen unchanged at 1.3% YoY during the reported month.

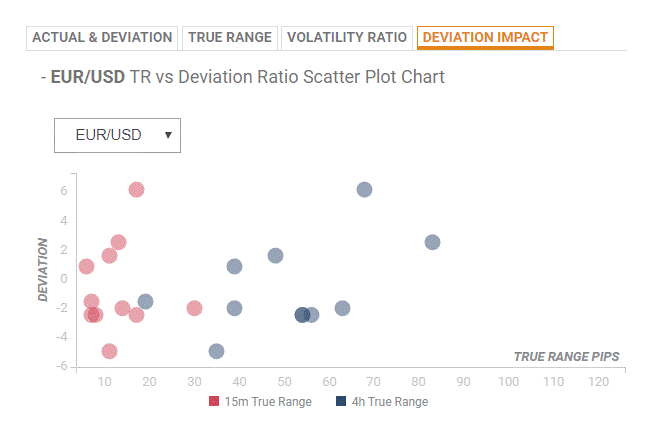

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 30 pips in deviations up to 1.5 to -2, although in some cases, if notable enough, a deviation can fuel movements of up to 45-50 pips.

How could affect EUR/USD?

Haresh Menghani, FXStreet's own Analyst, offers important technical levels ahead of the key release: “The pair was seen consolidating, rather forming a base above 100-hour SMA. Bulls, however, are likely to wait for a sustained move beyond the 1.1200 handle – coinciding with 23.6% Fibonacci level of 1.1066-1.1241 recent advance – before positioning for any further near-term appreciating move. Above the mentioned barrier, the pair seems all set to aim back towards testing multi-month tops, around the 1.1240 region.”

“On the flip side, immediate support is pegged near the 1.1175 region, which if broken might accelerate the slide further towards mid-1.1100s (50% Fibo.) en-route last Friday's swing low near the 1.1125 region (nearing 61.8% Fibo.). This is closely followed by the 1.1100 round figure mark. Failure to defend the said handle now seems to accelerate the slide further towards 100-day SMA”, Haresh adds.

Key notes

EUR/USD remains in uptrend channel but awaits breakout

Geopolitics amongst market movers today – Danske Bank

EUR Futures: rangebound likely in the near-term

About Eurozone Preliminary CPIs estimate

The Euro Zone CPI released by the Eurostat captures the changes in the price of goods and services. The CPI is a significant way to measure changes in purchasing trends and inflation in the Euro Zone. Generally, a high reading anticipates a hawkish attitude which will be positive (or bullish) for the EUR, while a low reading is seen as negative (or bearish).