AUD/JPY Price Analysis: Declines further below 200-bar SMA after PBOC rate cut

- AUD/JPY fails to hold onto the previous day’s gains amid downbeat fundamentals.

- PBOC rate cut, Aussie Unemployment Rate drive the prices lower.

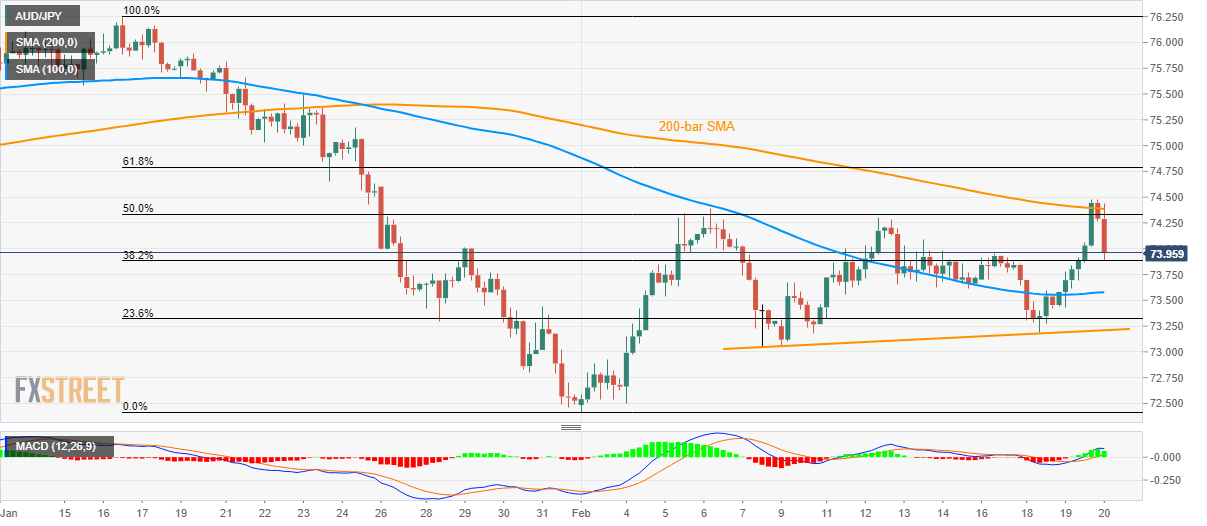

- Failure to sustain the break of 50% Fibonacci retracement, 200-bar SMA also weigh on the quote.

AUD/JPY declines to 74.05, with an intra-day low of 73.93, following the Interest Rate cut by the People’s Bank of China (PBOC) during the early Thursday. The pair earlier reversed from 200-bar SMA while taking clues from the Australian Unemployment Rate.

Read: Breaking: The People's Bank of China cut interest rates: AUD and Yuan sliding

The quote is now declining towards 38.2% Fibonacci retracement of its January month fall, at 73.88 whereas 100-bar SMA around 73.58 can please the sellers afterward.

During the quote’s additional weakness past-73.58, 23.6% Fibonacci retracement, at 73.23, followed by a two-week-old rising trend line around 73.20, can question the sellers.

On the upside, 50% Fibonacci retracement, 200-bar SMA and the latest highs can stop the pair’s recovery moves below 74.50.

However, a sustained run-up beyond 74.50 enables the bulls to aim for 61.8% Fibonacci retracement level of 74.80 and then to 75.00 round-figure.

AUD/JPY four-hour chart

Trend: Bearish