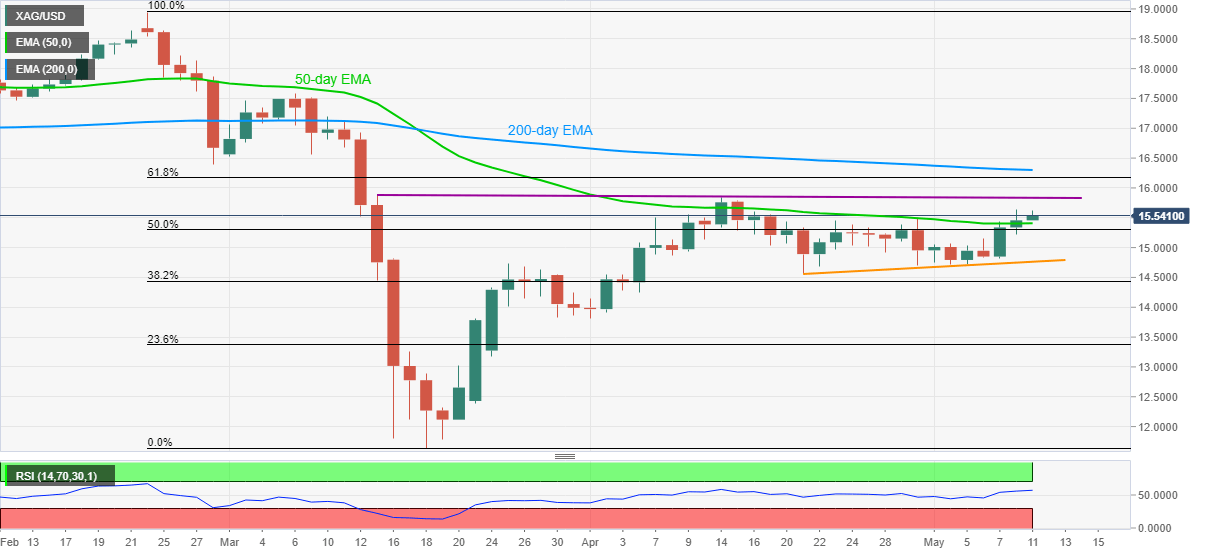

Silver Price Analysis: Bulls target two-month-old resistance line above $15.50

- Silver prints three-day winning streak, stays positive above 50-day EMA.

- 61.8% Fibonacci retracement, 200-day EMA add to upside resistance.

- A three-week-old support line follows 50% Fibonacci retracement as support.

Having successfully breached 50-day EMA, Silver prices take the bids near $15.54, up 0.56% on a day, during early Monday.

Considering the normal RSI conditions, as well as a sustained break above the near-term key resistance, the white metal is rising toward a falling trend line from March 13, currently around $15.85.

However, the bullion’s further upside is likely to be questioned by 61.8% Fibonacci retracement of February-March fall and 200-day EMA, respectively near $16.17 and $16.30.

Meanwhile, a downside break below the 50-day EMA level of $15.40 may take a rest on a 50% Fibonacci retracement level of $15.30 ahead of visiting short-term support line close to $14.75.

If at all silver prices remain pressured below $14.75, the April month low near $13.80 could lure the sellers.

Silver daily chart

Trend: Bullish