Back

13 May 2020

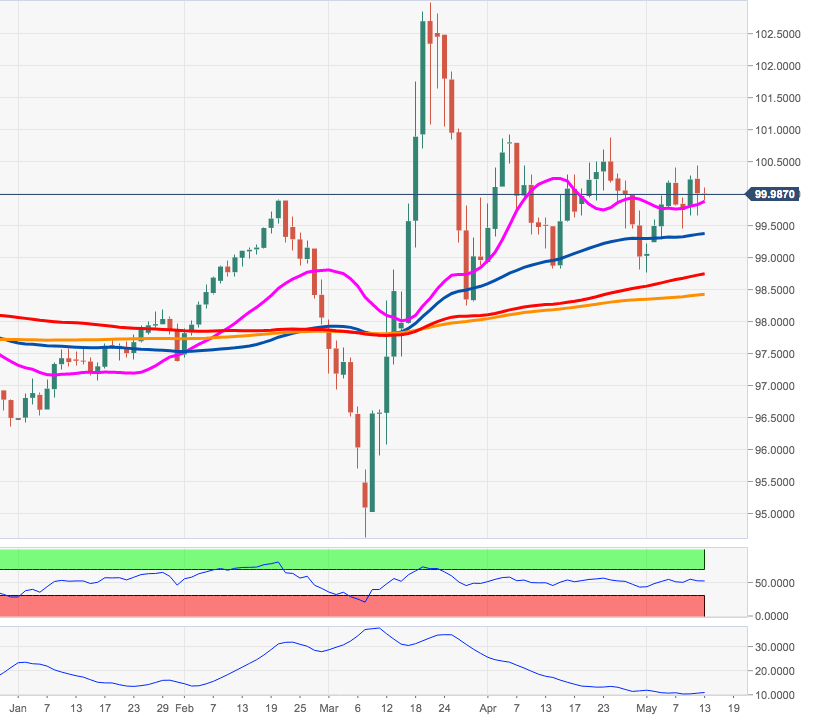

US Dollar Index Price Analysis: Looks consolidative in the short-term

- DXY has once again faltered at the key barrier in the mid-100.00s.

- A surpass of this area should put 101.00 back on the radar.

DXY is now navigating within a rangebound theme after another failed attempt to surpass the 100.50 area, where converge May tops and a Fibo retracement (of the 2017-2018 drop).

Further consolidation is not ruled out for the time being, although the inability to break above the 100.40/50 band could spark another correction lower.

Further out, the 200-day SMA – today at 98.41 - is expected to hold the downside in the short-term horizon.

DXY daily chart