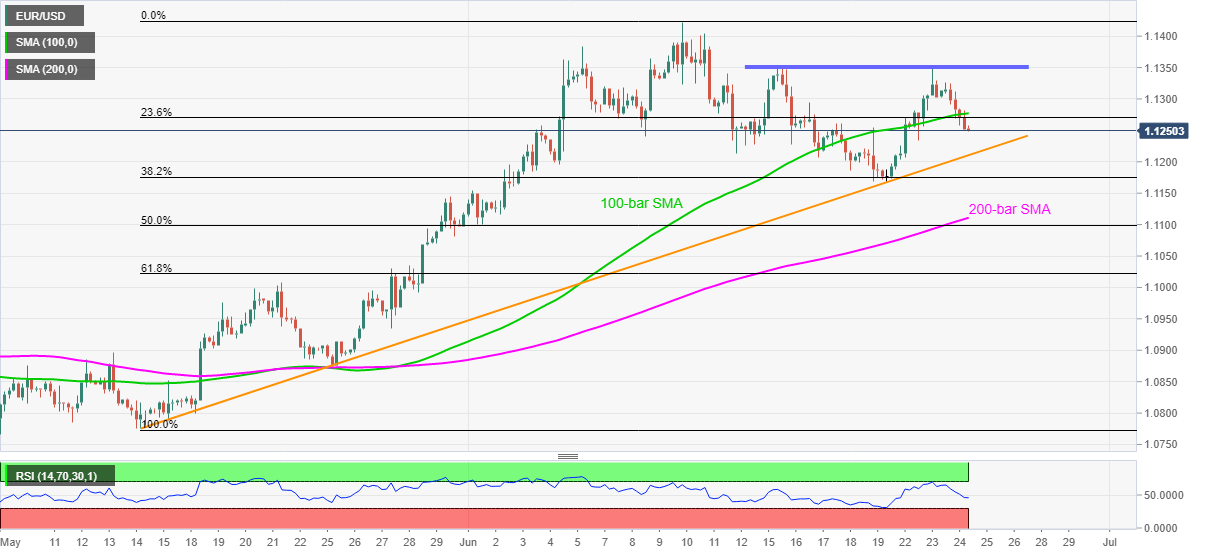

EUR/USD Price Analysis: Six-week-old support line on sellers’ radars below 1.1250

- EUR/USD slips below 100-bar SMA following a U-turn from 1.1349.

- 200-bar SMA adds to the supports, 1.1353 strengthens the upside barrier.

- A broad support line keeps the bulls hopeful despite increasing odds for short-term declines.

EUR/USD refreshes the intraday low near 1.1250 during the initial Asian session on Thursday. The pair recently accelerated downside moves after breaking 100-bar SMA. The same follows the quote’s U-turn from June 16 top on Tuesday.

Considering the pair’s weakness below the key SMA, further fall towards an ascending trend line from May 14, at 1.1210 now, becomes wide anticipated. However, June 21 low near 1.1170 and 200-bar SMA close to 1.1110 could challenge the bears afterward.

If at all the pair continues to drop past-1.1110, 61.8% Fibonacci retracement of May-June upside and May 21 top, respectively around 1.1021 and 1.1009, could return to the charts.

Alternatively, an upside break of a 100-bar SMA level of 1.1277 can trigger another effort to break the 1.1349/53 resistance region to refresh the monthly top beyond 1.1423.

EUR/USD four-hour chart

Trend: Further weakness expected