AUD/USD Price Analysis: Mildly bid inside nearby trading range below 0.7000

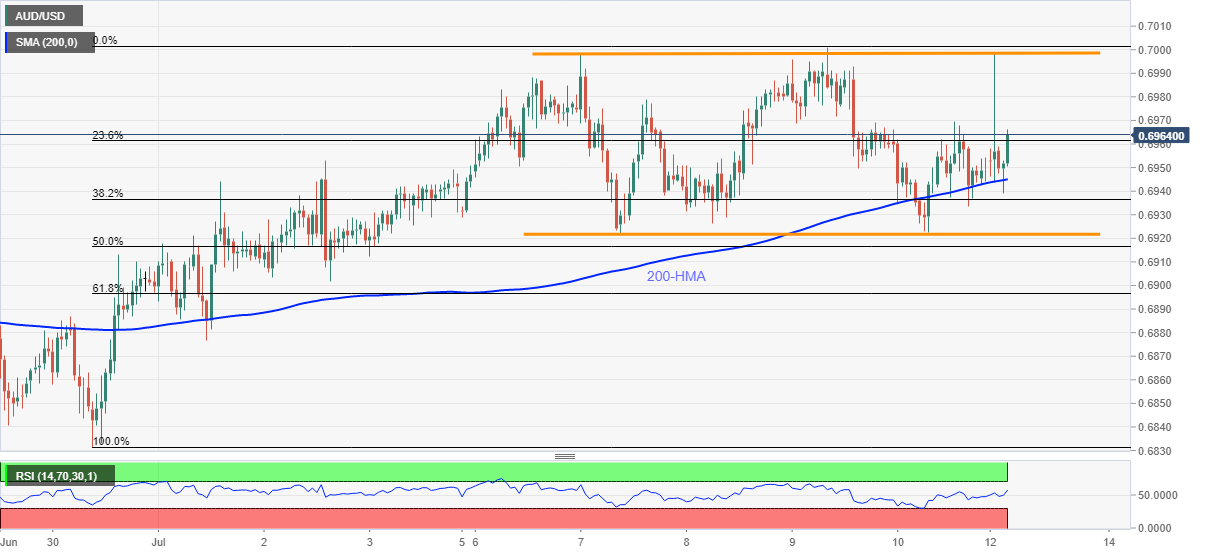

- AUD/USD bounces off 0.6939 to attack 0.7000 but stays inside a four-day-old trading range.

- 200-HMA offers intermediate support, 61.8% Fibonacci retracement adds to the downside filters.

- Bulls will have multiple resistances to conquer past-0.7000.

AUD/USD rises to 0.6960, up 0.13% on a day, during Monday’s Asian session. The aussie pair recently took a U-turn from 200-HMA while keeping a short-term trading range intact.

Looking at the normal RSI conditions and the quote’s latest recoveries from the key HMA, AUD/USD prices may again aim for 0.7000. However, its further upside will be challenged by the early-June tops surrounding 0.7030 ahead of highlighting the previous month’s high near 0.7065.

Additionally, July 2019 peak close to 0.7085 will become an extra upside barrier before fueling the pair towards 0.7100 threshold.

Meanwhile, a 200-HMA level of 0.6945 can stop sellers ahead of the range support near 0.6920.

If at all the quote slips below 0.6920, 0.6900 level comprising 61.8% Fibonacci retracement level of June 30 to July 09 upside will be the key as it holds the gate for the pair’s further downside.

AUD/USD hourly chart

Trend: Sideways