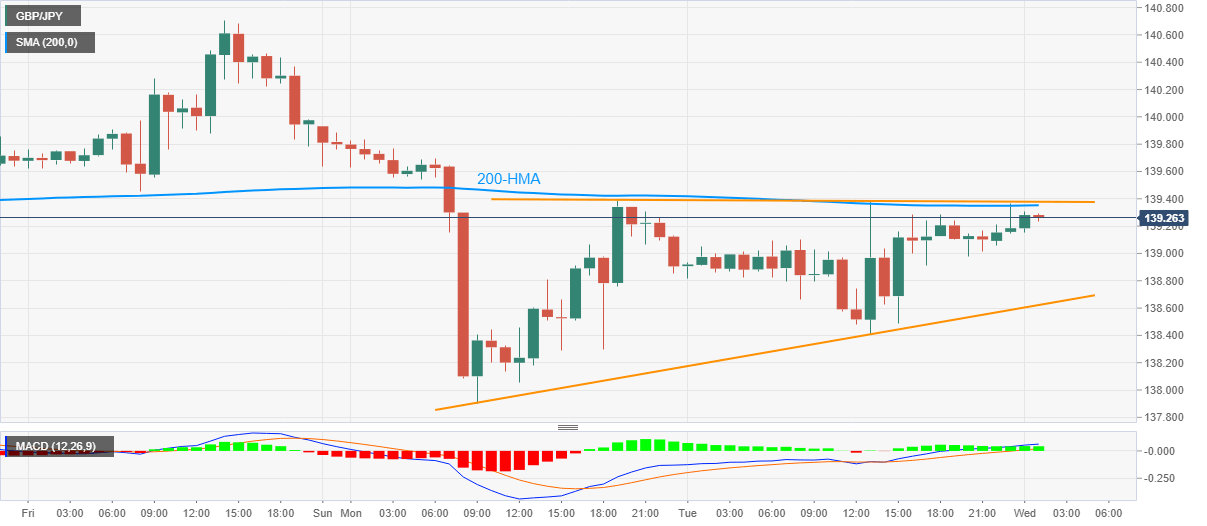

GBP/JPY Price Analysis: Bulls look for entries above 139.40

- GBP/JPY battles key resistance confluence the fourth time.

- 200-HMA, weekly ascending triangle’s upper line challenge bulls.

- Sellers will have to wait for the bearish chart pattern’s confirmation.

GBP/JPY trims intraday gains while declining to 139.25 during the early Wednesday’s trading. In doing so, the pair marks another failure to cross the key resistance convergence including 200-HMA and the resistance line of a short-term ascending triangle.

With the repeated pullbacks from the strong resistance, GBP/JPY sellers will wait for a confirmation of the triangle breakdown, with a sustained drop below 138.60, for fresh entries. However, an intermediate correction towards 139.00 and 138.80 can’t be ruled out.

During the quote’s downside past-138.60, the monthly low near 137.90 and November 19 bottom around 137.20 will be in the spotlight.

On the upside, a clear break of 139.40 will target the 140.00 threshold whereas the monthly high near 140.70 can return to the charts afterward.

In a case where the GBP/JPY bulls keep the reins above 140.70, the 142.00 round-figure will be on their radars.

GBP/JPY hourly chart

Trend: Pullback expected