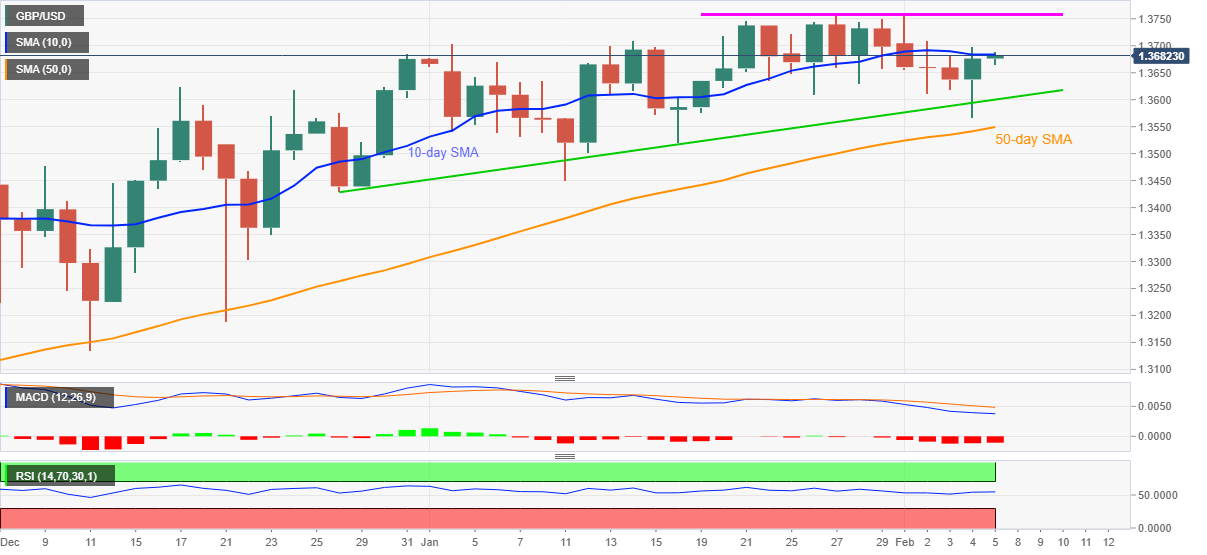

GBP/USD Price Analysis: Battles 10-day SMA below 1.3700

- GBP/USD extends bounce off three-week low to print two-day run-up.

- Strong RSI, receding bearish MACD and sustained upside beyond key supports favor the bull-run.

GBP/USD takes the bids near 1.3685, up 0.08% intraday, amid the initial hour of Friday’s Tokyo session. In doing so, the quote keeps the previous day’s swift move from late January lows while challenging 10-day SMA resistance.

Also favoring the bulls could be the upbeat RSI conditions and easing bearish bias of MACD.

It should, however, be noted that the GBP/USD bulls need a clear breakout of the stated SMA resistance, at 1.3685 now.

Following that, there are multiple hurdles around 1.3710-15 before challenging the multi-month top marked during 2021 near 1.3760.

On the downside, an ascending trend line from December 28, currently around 1.3600, becomes the key support, a break of which will portray another attempt to break 50-day SMA, at 1.3550 now.

Overall, GBP/USD is in an uptrend but the bulls portray a typical pre-NFP trading lull.

GBP/USD daily chart

Trend: Bullish