US Dollar Index regains the smile above 92.00 ahead of Powell

- DXY leaves behind Monday’s pullback and flirts with 92.00.

- US 10-year yields remain side-lined around the 1.40% level.

- Markets’ focus will be on Powell’s testimony later on Tuesday.

The US Dollar Index (DXY), which tracks the greenback vs. a bundle of its main competitors, regains some composure and edges higher to the 92.00 area.

US Dollar Index now looks to Powell

Following Monday’s pessimism in the dollar, the index manages to attract buying interest and looks to retake the area above the key 92.00 the figure so far on turnaround Tuesday.

The resurgence of the appetite for the riskier assets at the beginning of the week put the buck under some moderate pressure and forced it to recede from recent peaks near the 92.50 region.

Recent comments from FOMC’s Kaplan and Bullard – who somehow defended the Fed’s shift to a more hawkish message – lend extra support to the dollar and helped limit the downside for the time being.

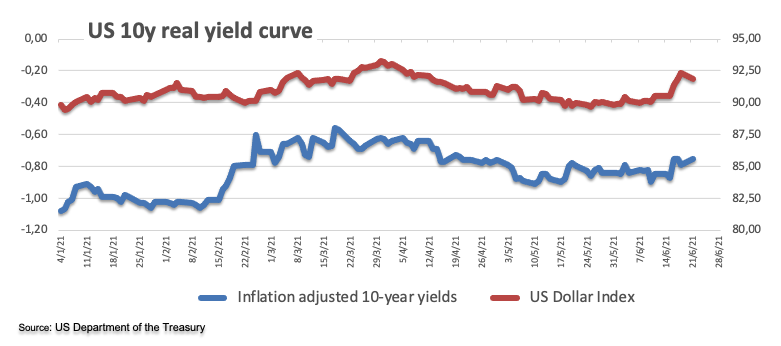

In the meantime, yields of the key US 10-year note remain depressed in the lower end of the recent range around the 1.40% zone.

In the calendar, all the attention is expected to be on the testimony by Chairman Powell before the Select Subcommittee on Coronavirus Crises on “The Federal Reserve’s Response to the Coronavirus Pandemic”.

Additional data will see Existing Home Sales for the month of May, the Richmond Fed Manufacturing Index, the API’s weekly report and the speech by San Francisco Fed M.Daly (voter, centrist).

What to look for around USD

The index failed once again near 92.50 followed by a moderate pullback to revisit the 92.00 neighbourhood at the beginning of the week, where it is now looking to stabilize. The likeliness that the tapering talk could kick in before anyone had anticipated and the view of higher rates in 2023 (or before) fuelled the sharp bounce in the buck to levels last seen in mid-April and introduced some uncertainty into the debate surrounding the extension of the “transient” inflation. The strong upside in DXY was also supported by higher yields in the shorter end of the curve, while yields of the key 10-year note stay muted around recent lows. In the meantime, further progress on the reopening of the economy, the vaccine rollout and results from key fundamentals remain key for the dollar’s price action/sentiment in the short-term horizon.

Key events in the US this week: Chairman Powell’s testimony, Existing Home Sales (Tuesday) – New Home Sales, flash Manufacturing PMI (Wednesday) – Final Q1 GDP, Durable Goods Orders, Initial Claims (Thursday) – Core PCE, final June Consumer Sentiment (Friday).

Eminent issues on the back boiler: Biden’s plans to support infrastructure and families, worth nearly $6 trillion. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating?

US Dollar Index relevant levels

Now, the index is gaining 0.20% at 92.02 and a breakout of 92.40 (monthly high Jun.18) would open the door to 92.46 (23.6% Fibo level of the 2020-2021 drop) and finally 93.43 (2021 high Mar.21). On the other hand, the next support is located at 91.50 (200-day SMA) followed by 91.11 (100-day SMA) and finally 89.53 (monthly low May 25).