Gold Price Forecast: XAU/USD bears sinking in their teeth as USD pops

- Gold is under pressure in Asia as the bears step in and bulls back the US dollar.

- US CPI is the highest in 40-years and the Fed is now expected to act in kind.

Trading in a tight $3.50c/oz range in Asia Friday, with Japan out on holiday, gold, XAU/USD, is flat on the day so far following a lively day on Wall Street following the hot US inflation data. Gold is trading near $1,825 at the time of writing and is oscillating at the foot of the bearish daily close from Thursday's business.

US CPI highest in 40-years

The January Consumer Price Index data was showing a 7.5% YoY lift in prices which spooked markets on Thursday. On a core basis, inflation lifted 6.0% YoY after gaining 0.6% during January. Both the core and headline inflation were stronger than expected. The data added to the view of some investors that the Federal Reserve may need to act aggressively to curb rising inflation.

Fed's James Bullard now wants a full percentage point of interest rate hikes over the next three central bank policy meetings. He even said the Fed could rate hike san inter-meetings and some Fed watchers have taken that to mean that there could be an emergency meeting and subsequent rate hike before the March meeting.

As a consequence major US stock indexes ended sharply lower and Asia follows suit. The Nasdaq was falling more than 2% when the US 10-Year Treasury yield touched 2% for the first time since August 2019. The dollar index (DXY), a gauge of the greenback's value against six major currencies, jumped 0.5% but ended almost flat as currency markets accounted for the macro inflation outlook and started to position into commodity currencies also. AUD/USD rallied to test 0.72 the figure on the notion that commodity prices would climb. However, the bulls have met a wall of supply there and the price is falling below a key 0.7150 level in Asia as the US dollar starts to attract buyers again here in Asia.

''Ultimately, we expect that macro headwinds will catalyze a breakdown in price,'' analysts at TD Securities had to say on their outlook for gold prices. ''Our ChartVision framework further supports our view, suggesting that a break below $1750/oz by July 2022 would be consistent with a sustained downtrend in the yellow metal.''

Gold technical analysis

Staying with the pre-US CPI analysis from the prior sessions, the outlook is bearish.

Gold prior analysis

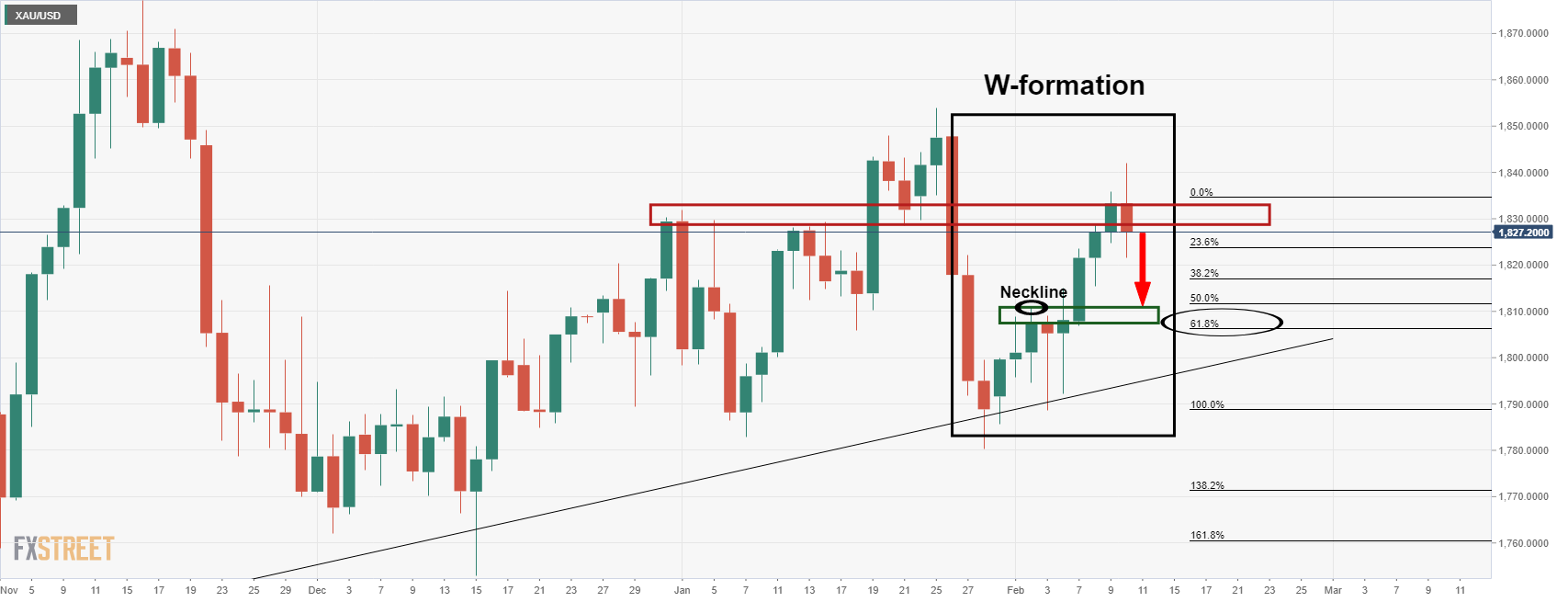

In the chart below, it was shown that the price has reached the neckline of the M-formation to the rounded down $1,828.

This mattered because this is an area of liquidity that could lead to supply entering the market which would typically cap the price. This leaves the focus on the downside which leaves the $1,811 vulnerable:

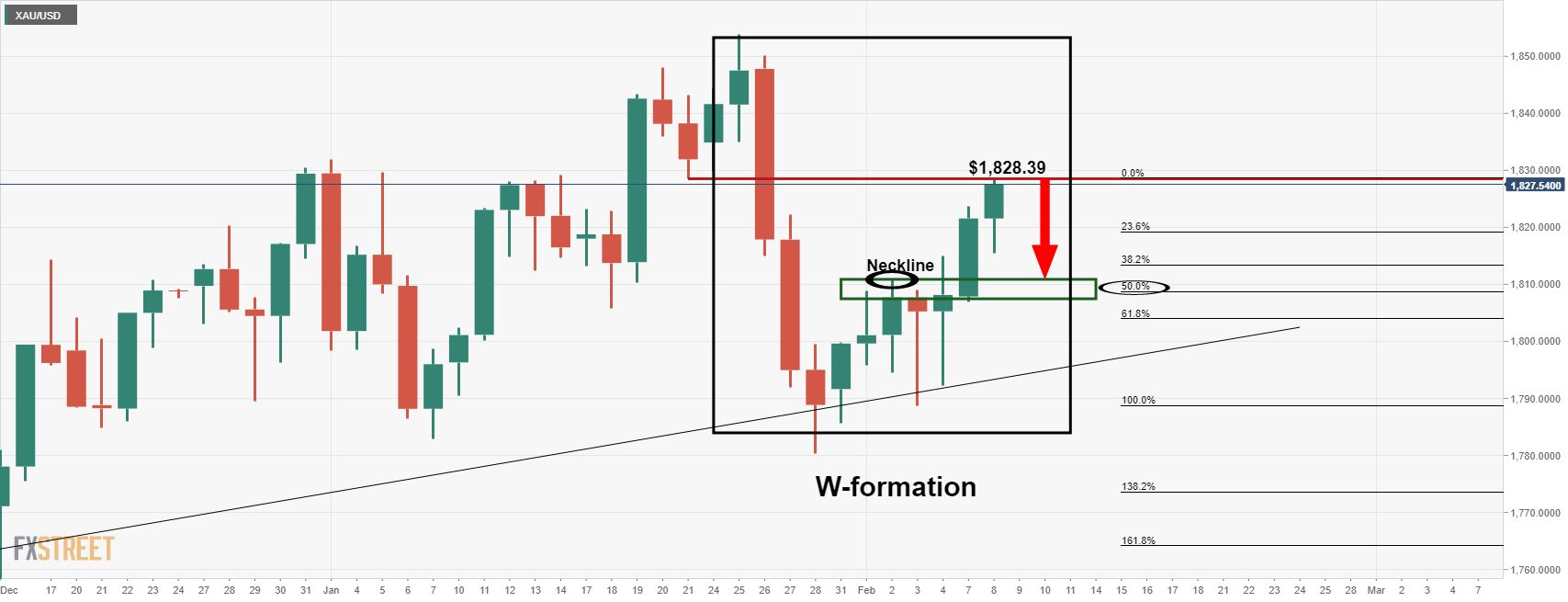

It was stated that the W-formation's neckline aligned near a 50% mean reversion of the prior bullish impulse in an ''area'' between $1,811 and $1,808 where the bears could be looking to target.

Gold live market